Orbital Energy Group, Inc. (OEG): Price and Financial Metrics

OEG Price/Volume Stats

| Current price | $0.64 | 52-week high | $3.67 |

| Prev. close | $0.60 | 52-week low | $0.51 |

| Day low | $0.58 | Volume | 3,024,100 |

| Day high | $0.70 | Avg. volume | 1,586,443 |

| 50-day MA | $0.76 | Dividend yield | N/A |

| 200-day MA | $1.65 | Market Cap | 55.87M |

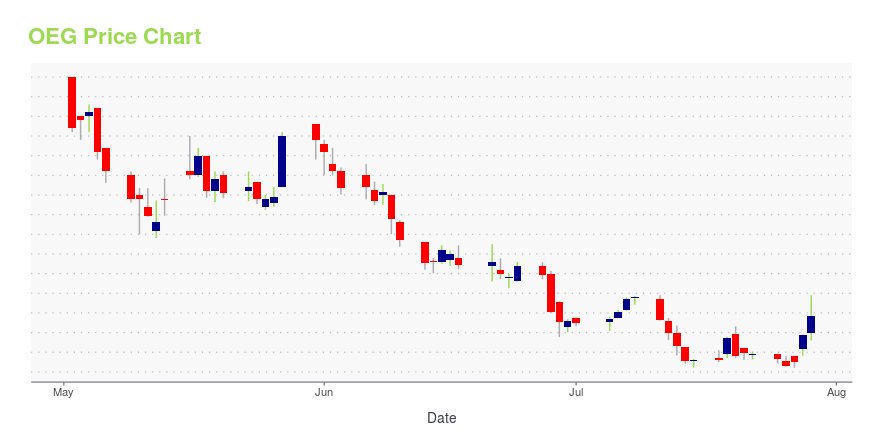

OEG Stock Price Chart Interactive Chart >

Orbital Energy Group, Inc. (OEG) Company Bio

Orbital Energy Group, Inc. is a publicly traded company. The Company specializes in the acquisition and development of innovative companies to create a diversified energy infrastructure services platform. Orbital Energy Group serves customers in the United State and United Kingdom.

Latest OEG News From Around the Web

Below are the latest news stories about ORBITAL ENERGY GROUP INC that investors may wish to consider to help them evaluate OEG as an investment opportunity.

ORBITAL ENERGY GROUP, INC. REBRANDS TO ORBITAL INFRASTRUCTURE GROUP, INC.Orbital Energy Group, Inc. (NASDAQ: OEG), a diversified infrastructure services platform, providing engineering, design, construction, and maintenance services to customers in the electric power, telecommunications, and renewable industries, today announced the rebranding of the company to Orbital Infrastructure Group, Inc. (NASDAQ: OIG) ("OIG" or the "Company"), to align with the Company's infrastructure strategy, and its continued expansion and market diversification. In addition to rebranding |

Shareholders in Orbital Energy Group (NASDAQ:OEG) are in the red if they invested a year agoAs every investor would know, you don't hit a homerun every time you swing. But serious investors should think long and... |

OEG: Diversified infrastructure services provider entering new growth phase as it targets three key end markets – Electric Power, Telecommunications, and Renewable Energy.By Thomas Kerr, CFA NASDAQ:OEG Overview Orbital Energy Group, Inc. (NASDAQ:OEG) is a diversified infrastructure services company serving a variety of customers in the electric power, telecommunications, and renewable markets. The company’s operations are classified into three diverse segments: Electric Power, Telecommunications, and Renewables. Recent acquisitions have transformed the company |

Future Outlook And Stock Price Performance For Orbital Energy Group Inc. (NASDAQ: OEG)In the last trading session, 1.36 million shares of the Orbital Energy Group Inc. (NASDAQ:OEG) were traded, and its beta was 1.34. Most recently the company’s share price was $0.60, and it changed around -$0.03 or -4.91% from the last close, which brings the market valuation of the company to $51.74M. OEG currently trades at … Future Outlook And Stock Price Performance For Orbital Energy Group Inc. (NASDAQ: OEG) Read More » |

DGAP-News: Upgrading the Decaying US Energy Grid with Renewables. Interview with Jim O’Neil Vice Chairman and CEO, Orbital Energy Group, Inc.DGAP-News: Orbital Energy Group, Inc. Upgrading the Decaying US Energy Grid with Renewables. Interview with Jim O’Neil Vice Chairman and CEO, Orbital Energy Group, Inc. 17.06.2022 / 15:00 The issuer is solely responsible for the content of this announcement. Contact Details Orbital Energy Group |

OEG Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -82.17% |

| 5-year | -17.95% |

| YTD | N/A |

| 2023 | N/A |

| 2022 | 0.00% |

| 2021 | 0.00% |

| 2020 | 99.09% |

| 2019 | -10.57% |

Loading social stream, please wait...