Orion Energy Systems, Inc. (OESX): Price and Financial Metrics

OESX Price/Volume Stats

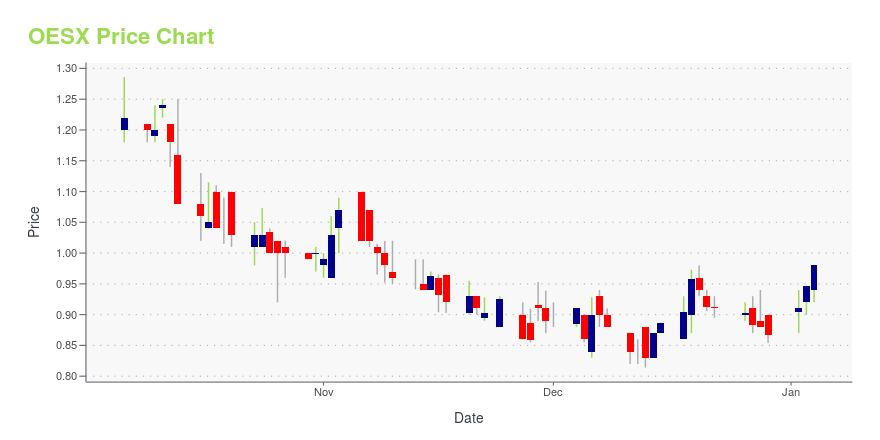

| Current price | $1.07 | 52-week high | $1.77 |

| Prev. close | $1.03 | 52-week low | $0.81 |

| Day low | $1.03 | Volume | 27,252 |

| Day high | $1.08 | Avg. volume | 53,256 |

| 50-day MA | $1.07 | Dividend yield | N/A |

| 200-day MA | $0.98 | Market Cap | 35.04M |

OESX Stock Price Chart Interactive Chart >

Orion Energy Systems, Inc. (OESX) Company Bio

Orion Energy Systems Inc designs, manufactures, and implements energy management systems. The Company's management system is comprised of high intensity fluorescent lighting system, InteLite intelligent lighting controls, and Apollo Light Pipe. Orion Energy Systems offers energy savings and efficiency gains to commercial and industrial customers.

Latest OESX News From Around the Web

Below are the latest news stories about ORION ENERGY SYSTEMS INC that investors may wish to consider to help them evaluate OESX as an investment opportunity.

Sidoti Events, LLC’s Virtual November Micro-Cap ConferenceNEW YORK, NY / ACCESSWIRE / November 14, 2023 / Sidoti Events, LLC, an affiliate of Sidoti & Company, LLC, has released the presentation schedule and weblinks for its two-day November Micro-Cap Conference taking place Wednesday and Thursday, November ... |

Orion Energy Systems, Inc. (NASDAQ:OESX) Q2 2024 Earnings Call TranscriptOrion Energy Systems, Inc. (NASDAQ:OESX) Q2 2024 Earnings Call Transcript November 7, 2023 Orion Energy Systems, Inc. beats earnings expectations. Reported EPS is $-0.14, expectations were $-0.15. Operator: [Technical Difficulty] Fiscal 2024 Second Quarter Conference Call. At this time, all participants are in a listen-only mode. [Operator Instructions]. Please be advised that today’s conference is […] |

Q2 2024 Orion Energy Systems Inc Earnings CallQ2 2024 Orion Energy Systems Inc Earnings Call |

Orion Energy Systems Inc (OESX) Q2'24 Revenue Grows 17% to $20.6MCompany maintains 30% revenue growth outlook for FY 2024 |

LED Lighting, Maintenance and EV Charging Solutions Provider Orion’s Q2’24 Revenue Rose 17% to $20.6M; Maintains 30% Revenue Growth Outlook for FY 2024MANITOWOC, Wis., Nov. 07, 2023 (GLOBE NEWSWIRE) -- Orion Energy Systems, Inc. (NASDAQ: OESX) (Orion Lighting), a provider of energy-efficient LED lighting, maintenance services and electric vehicle (EV) charging station solutions, today reported results for its fiscal 2024 second quarter (Q2’24) ended September 30, 2023. Orion will hold an investor call today at 10:00 a.m. ET – details below. Q2 Financial Summary Prior Three Quarters$ in millions except per share figuresQ2’24Q2’23Change Q1’24Q4’ |

OESX Price Returns

| 1-mo | -10.83% |

| 3-mo | 27.37% |

| 6-mo | -0.93% |

| 1-year | -35.54% |

| 3-year | -78.34% |

| 5-year | -62.98% |

| YTD | 23.47% |

| 2023 | -52.38% |

| 2022 | -49.72% |

| 2021 | -63.32% |

| 2020 | 194.63% |

| 2019 | 487.72% |

Continue Researching OESX

Want to see what other sources are saying about Orion Energy Systems Inc's financials and stock price? Try the links below:Orion Energy Systems Inc (OESX) Stock Price | Nasdaq

Orion Energy Systems Inc (OESX) Stock Quote, History and News - Yahoo Finance

Orion Energy Systems Inc (OESX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...