Organon & Co. (OGN): Price and Financial Metrics

OGN Price/Volume Stats

| Current price | $9.46 | 52-week high | $23.10 |

| Prev. close | $9.64 | 52-week low | $8.01 |

| Day low | $9.40 | Volume | 3,132,200 |

| Day high | $9.78 | Avg. volume | 4,473,437 |

| 50-day MA | $9.48 | Dividend yield | 0.83% |

| 200-day MA | $0.00 | Market Cap | 2.46B |

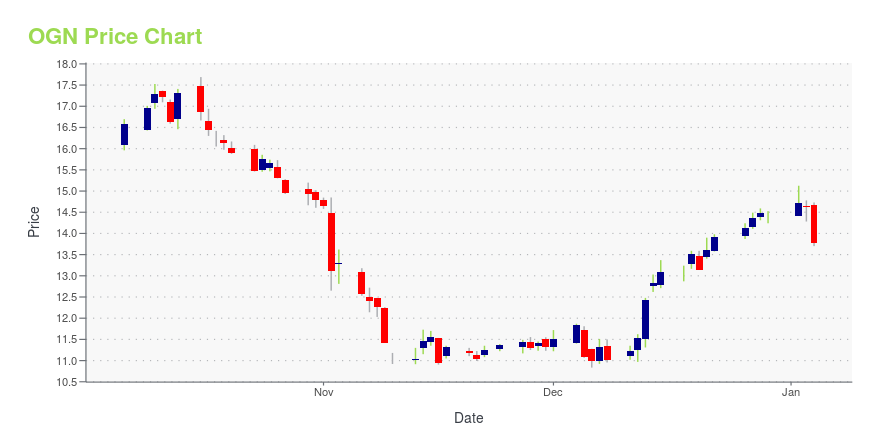

OGN Stock Price Chart Interactive Chart >

Organon & Co. (OGN) Company Bio

Organon & Co. Organon & Co. is a science-based global pharmaceutical company. The Company is engaged in developing and delivering health solutions through a portfolio of prescription therapies within women's health, biosimilars and established brands. Its women's health portfolio includes Nexplanon or Implanon NXT, which is a patented long-acting reversible contraceptive. Its operating segments include the Organon Products segment. The Organon Products segment is engaged in developing and delivering health solutions through its portfolio of prescription therapies within women's health, biosimilars, and established brands. The Company's products segment portfolio includes: Women's Health, Biosimilars and Established Brands. Women's Health contains contraception and fertility brands, such as Nexplanon or Implanon NXT, NuvaRing and elonva. The Company's Biosimilars portfolio consists of three immunology products: Brenzys, Renflexis and Hadlima; and two oncology products: Ontruzant and Aybintio.

OGN Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -52.50% |

| 3-year | -64.84% |

| 5-year | N/A |

| YTD | -35.28% |

| 2024 | 9.92% |

| 2023 | -45.12% |

| 2022 | -4.86% |

| 2021 | N/A |

| 2020 | N/A |

OGN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...