The OLB Group, Inc. (OLB): Price and Financial Metrics

OLB Price/Volume Stats

| Current price | $2.62 | 52-week high | $11.70 |

| Prev. close | $2.71 | 52-week low | $2.42 |

| Day low | $2.56 | Volume | 4,975 |

| Day high | $2.80 | Avg. volume | 20,036 |

| 50-day MA | $3.22 | Dividend yield | N/A |

| 200-day MA | $5.90 | Market Cap | 4.74M |

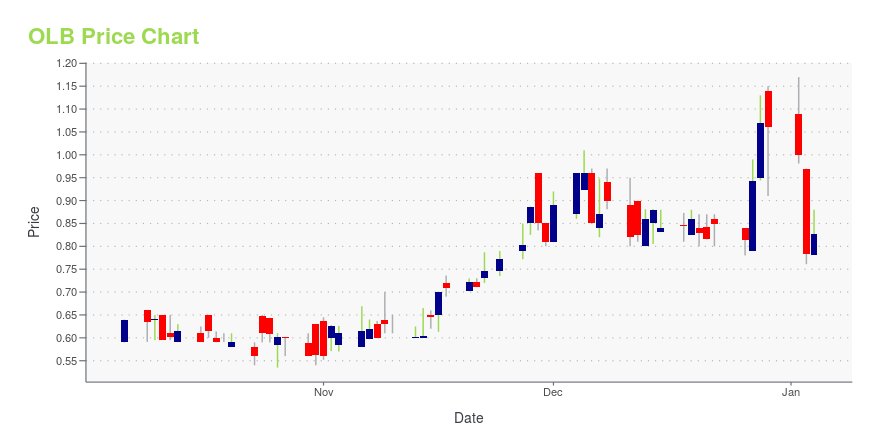

OLB Stock Price Chart Interactive Chart >

The OLB Group, Inc. (OLB) Company Bio

The OLB Group, Inc. develops application software. The Company designs online shopping systems to purchase food and other related things, as well as allows payment services. OLB Group serves customers in the State of New York.

Latest OLB News From Around the Web

Below are the latest news stories about OLB GROUP INC that investors may wish to consider to help them evaluate OLB as an investment opportunity.

OLB Group Announces Financial Results for 2023 Third QuarterNEW YORK, NY / ACCESSWIRE / November 15, 2023 / OLB Group, Inc. (NASDAQ:OLB), a diversified Fintech eCommerce merchant services provider and Bitcoin mining enterprise, announced today its financial results for the Third Quarter ending September 30, ... |

Favourable Signals For OLB Group: Numerous Insiders Acquired StockGenerally, when a single insider buys stock, it is usually not a big deal. However, when several insiders are buying... |

OLB Group to Conduct Second Quarter Earnings Call November 15NEW YORK, NY / ACCESSWIRE / November 14, 2023 / The OLB Group, Inc. (NASDAQ:OLB), a diversified Fintech eCommerce merchant services provider and Bitcoin mining enterprise, will hold an Earnings Conference Call on November 15, 2023 at 4:30 PM Eastern ... |

DMINT, Inc. Announces Confidential Submission of Draft Form S-1 Registration StatementNEW YORK, NY / ACCESSWIRE / October 16, 2023 / DMINT, Inc., a wholly-owned subsidiary of The OLB Group, Inc. (NASDAQ:OLB), a diversified payments company, announced today that it has confidentially submitted a draft registration statement on Form ... |

OLB Group Inc. to Participate in 2023 M-Vest Virtual Tech Conference Series on October 10 - October 11NEW YORK, NY / ACCESSWIRE / October 9, 2023 / OLB Group, Inc. (NASDAQ:OLB), a diversified payments company with a Bitcoin mining subsidiary (DMint) to be spun off to shareholders, announced today that Ronny Yakov, CEO of OLB Group,will present at ... |

OLB Price Returns

| 1-mo | -9.66% |

| 3-mo | -27.46% |

| 6-mo | -69.01% |

| 1-year | -73.27% |

| 3-year | -95.55% |

| 5-year | N/A |

| YTD | -75.28% |

| 2023 | 26.36% |

| 2022 | -68.34% |

| 2021 | -46.36% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...