Olink Holding AB (publ) (OLK): Price and Financial Metrics

OLK Price/Volume Stats

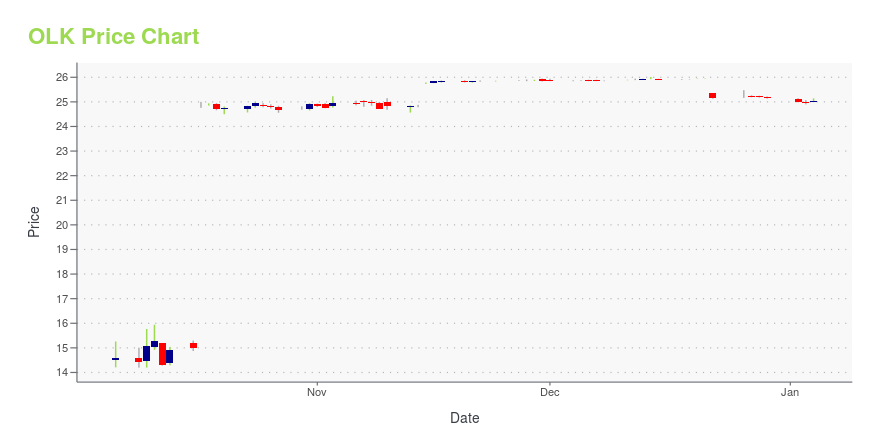

| Current price | $26.08 | 52-week high | $26.09 |

| Prev. close | $26.00 | 52-week low | $14.10 |

| Day low | $25.98 | Volume | 1,890,200 |

| Day high | $26.09 | Avg. volume | 633,228 |

| 50-day MA | $24.39 | Dividend yield | N/A |

| 200-day MA | $23.55 | Market Cap | 3.24B |

OLK Stock Price Chart Interactive Chart >

Olink Holding AB (publ) (OLK) Company Bio

Olink Holding AB (publ) provides various products and services for academic, government, biopharmaceutical, biotechnology, and other institutions focused on life science research. Its products include Olink Explore for cardiovascular and metabolic diseases, oncology, neurology, or inflammation; Olink Target product line; and Olink Focus product line consists of custom developed solutions for customers that have identified a small number of proteins of interest to focus on.

Latest OLK News From Around the Web

Below are the latest news stories about OLINK HOLDING AB (PUBL) that investors may wish to consider to help them evaluate OLK as an investment opportunity.

Olink reports third quarter 2023 financial resultsUPPSALA, Sweden, Nov. 15, 2023 (GLOBE NEWSWIRE) -- Olink Holding AB (publ) (“Olink”) (Nasdaq: OLK) today announced its unaudited financial results for the third quarter ended September 30, 2023. Highlights Third quarter 2023 revenue totaled $44.2 million, representing year over year growth of 39% on a reported basis and 38% on a constant currency adjusted like-for-like basisTotal Explore customer installations reached 87, with 13 installations during the third quarterTotal Signature Q100 placeme |

Breakeven On The Horizon For Olink Holding AB (publ) (NASDAQ:OLK)With the business potentially at an important milestone, we thought we'd take a closer look at Olink Holding AB... |

Why Earnings Season Could Be Great for Olink (OLK)Olink (OLK) is seeing favorable earnings estimate revision activity and has a positive Zacks Earnings ESP heading into earnings season. |

Novogene Asia Pacific Middle East and Africa adopts Olink® Explore HT technology to accelerate multi-omics research with next generation proteomicsUPPSALA, Sweden, Nov. 06, 2023 (GLOBE NEWSWIRE) -- Olink Holding AB (publ) (“Olink”) (Nasdaq: OLK) today announced that Novogene Asia Pacific Middle East and Africa (AMEA) has adopted the Olink Explore HT platform to deliver advanced next-generation proteomics technology to the scientific community in the region. Novogene is a leading provider of genomic services and solutions offering extensive next generation sequencing (NGS) capacity and bioinformatics expertise. The addition of Olink Explore |

Should You Still Buy the Nasdaq's Best-Performing October Stocks?Last month's big winners were tricky to handle due to the amount of speculation investors were willing to do with them. |

OLK Price Returns

| 1-mo | 3.62% |

| 3-mo | 14.19% |

| 6-mo | 3.90% |

| 1-year | 44.73% |

| 3-year | -29.44% |

| 5-year | N/A |

| YTD | 3.70% |

| 2023 | -0.91% |

| 2022 | 39.45% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...