Ohmyhome Ltd. (OMH): Price and Financial Metrics

OMH Price/Volume Stats

| Current price | $0.54 | 52-week high | $6.00 |

| Prev. close | $0.53 | 52-week low | $0.46 |

| Day low | $0.53 | Volume | 41,472 |

| Day high | $0.54 | Avg. volume | 980,318 |

| 50-day MA | $0.56 | Dividend yield | N/A |

| 200-day MA | $1.15 | Market Cap | 12.24M |

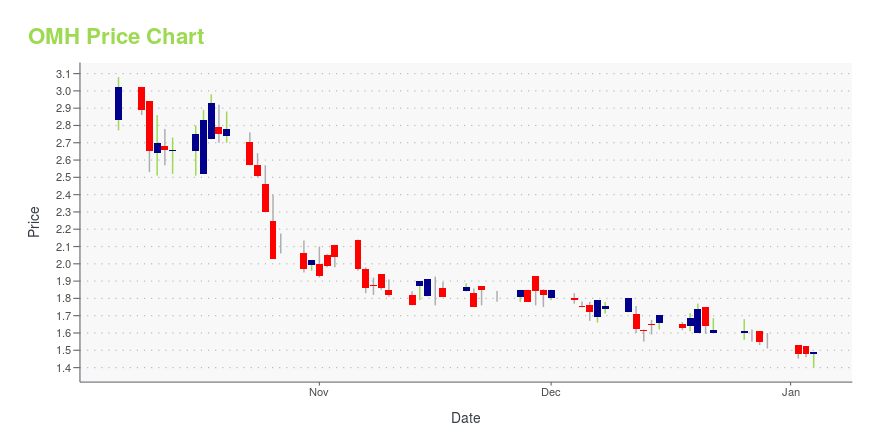

OMH Stock Price Chart Interactive Chart >

Latest OMH News From Around the Web

Below are the latest news stories about OHMYHOME LTD that investors may wish to consider to help them evaluate OMH as an investment opportunity.

How this company is bringing an Uber-approach to buying and selling your homeRhonda Wong, founder of Ohmyhome, joined TheStreet to discuss how her company is taking a fresh approach to real estate. |

OMH: Initiating Coverage - Positioning to Benefit From Growing Real Estate MarketBy M. Marin NASDAQ:OMH READ THE FULL OMH RESEARCH REPORT Expanding suite of offerings via organic product / service launches, affiliations, strategic M&A… Singapore-based technology company Ohmyhome Ltd (NASDAQ:OMH) operates an online real estate platform that it believes provides a one-stop solution for a broad range of services for property buyers, sellers, renters and renovators. The |

Ohmyhome Ltd. Announces Acquisition of Simply Sakal, a Leading Singapore Tech-Enabled Property Management Company, Creating Property “Super App”Ohmyhome Ltd Simply Sakal Pte. Ltd. Strategic transaction creates an industry leading one-stop-shop property “Super App”Enhances Ohmyhome’s comprehensive technology and service offering to end-customers around buying, selling, renovating, and managing propertiesTransaction is expected to be accretive to Ohmyhome’s revenue growth and earnings in 2024, the first full year after its close, and lead to a positive EBITDA in 2025 upon the realization of the synergies Singapore, Oct. 11, 2023 (GLOBE NE |

Ohmyhome First Half 2023 Earnings: S$0.13 loss per share (vs S$0.057 loss in 1H 2022)Ohmyhome ( NASDAQ:OMH ) First Half 2023 Results Key Financial Results Revenue: S$2.17m (down 36% from 1H 2022). Net... |

Ohmyhome Reports First Half 2023 Results and Is Geared For 3X Growth in 2024Ohmyhome achieves S$2.2 million revenue in 1H 2023, partners with a US portal for cross border transactions between USA and SouthEast Asia, geared for 3X Growth in 2024 and a positive EBITDA in 2025 ●Revenues totaled S$2.2 million ●Net income loss totaled S$2.5 million, or S$0.13 per diluted share ●Cash and Cash Equivalents totaled S$6.3 million ●Ohmyhome sellers continue to sell above valuation 60% of the time. Total number of transactions reached 14,500, and total GTV reached US$2.9 billion. ● |

OMH Price Returns

| 1-mo | -7.26% |

| 3-mo | -5.20% |

| 6-mo | -48.57% |

| 1-year | -82.06% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | -64.71% |

| 2023 | N/A |

| 2022 | N/A |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...