OceanPal Inc. (OP): Price and Financial Metrics

OP Price/Volume Stats

| Current price | $1.55 | 52-week high | $3.17 |

| Prev. close | $1.88 | 52-week low | $0.63 |

| Day low | $1.49 | Volume | 1,226,880 |

| Day high | $1.75 | Avg. volume | 1,948,260 |

| 50-day MA | $1.17 | Dividend yield | N/A |

| 200-day MA | $1.21 | Market Cap | 11.63M |

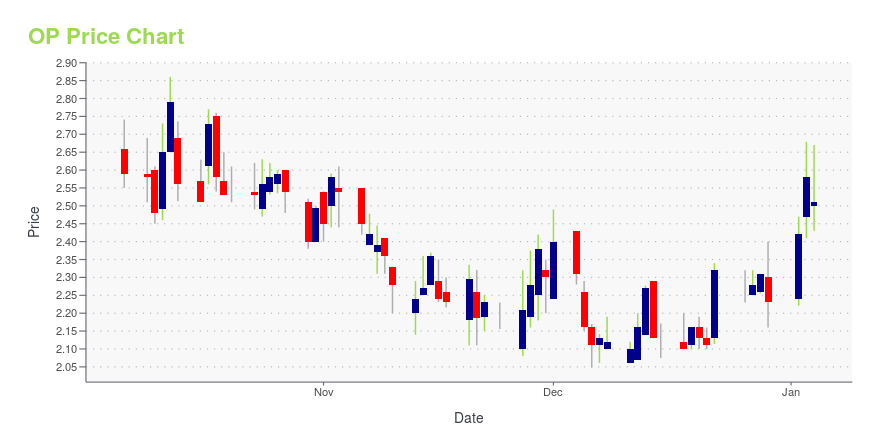

OP Stock Price Chart Interactive Chart >

OceanPal Inc. (OP) Company Bio

OceanPal, Inc. operates as a holding company that provides ocean-going transportation services. It owns and operates dry bulk carriers that transport heavy bulks such as iron ore, coal and grains, and minor bulks such as bauxite, phosphate and fertilizers. The company intends to expand fleet and acquire dry bulk carriers as well as vessels in other sectors. It also intends to acquire additional vessels in the secondhand market, including acquisitions from unrelated third parties. The company was founded on April 15, 2021 and is headquartered in Athens, Greece.

OP Price Returns

| 1-mo | -3.73% |

| 3-mo | 124.31% |

| 6-mo | 25.01% |

| 1-year | -20.92% |

| 3-year | -98.19% |

| 5-year | N/A |

| YTD | 33.62% |

| 2024 | -47.98% |

| 2023 | -89.95% |

| 2022 | -93.93% |

| 2021 | N/A |

| 2020 | N/A |

Loading social stream, please wait...