OpGen, Inc. (OPGN): Price and Financial Metrics

OPGN Price/Volume Stats

| Current price | $3.06 | 52-week high | $38.40 |

| Prev. close | $3.06 | 52-week low | $1.65 |

| Day low | $3.01 | Volume | 4,996 |

| Day high | $3.06 | Avg. volume | 89,212 |

| 50-day MA | $2.98 | Dividend yield | N/A |

| 200-day MA | $4.56 | Market Cap | 4.13M |

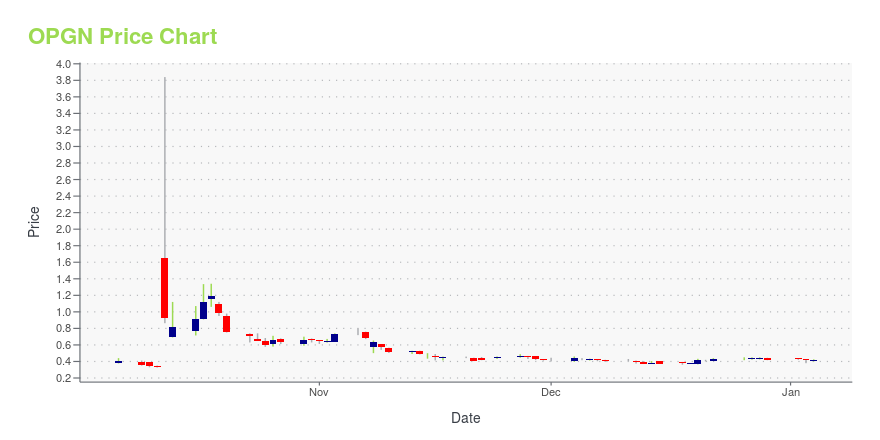

OPGN Stock Price Chart Interactive Chart >

Latest OPGN News From Around the Web

Below are the latest news stories about OPGEN INC that investors may wish to consider to help them evaluate OPGN as an investment opportunity.

OpGen Reports Third Quarter 2023 Financial Results and Provides Business UpdateTotal revenue for the first nine months of 2023 was approximately $2.35 million compared to approximately $1.89 million in the first nine months of 2022Implemented certain cash management initiatives, including restructuring U.S. operations by reducing headcount during the third quarter of 2023Signed preferred stock purchase agreement with a potential strategic investor in October 2023Entered into a warrant inducement agreement with an institutional investor in October 2023Subsidiaries Curetis G |

Why Is OpGen (OPGN) Stock Up 540% Today?OpGen stock is undergoing a massive rally on Thursday following as OPGN investors react to two pieces of news from the company! |

Why Is Phio Pharma (PHIO) Stock Down 35% Today?Phio Pharma stock is pulling back on Thursday after shares of PHIO underwent a massive rally on Wednesday with a preclinical trial update. |

Why Is Secoo (SECO) Stock Up 703% Today?Secoo stock is experiencing a massive rally on Thursday with heavy trading of SECO shares despite a lack of news from the company. |

Why Is Tempest Therapeutics (TPST) Stock Down 35% Today?Tempest Therapeutics stock is taking a beating on Thursday as shares of TPST retreat from a massive rally yesterday on clinical trial news! |

OPGN Price Returns

| 1-mo | 19.07% |

| 3-mo | -40.57% |

| 6-mo | -12.07% |

| 1-year | -45.16% |

| 3-year | -99.30% |

| 5-year | -99.79% |

| YTD | -27.14% |

| 2023 | -85.11% |

| 2022 | -85.90% |

| 2021 | -50.98% |

| 2020 | 80.53% |

| 2019 | -95.65% |

Continue Researching OPGN

Want to see what other sources are saying about Opgen Inc's financials and stock price? Try the links below:Opgen Inc (OPGN) Stock Price | Nasdaq

Opgen Inc (OPGN) Stock Quote, History and News - Yahoo Finance

Opgen Inc (OPGN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...