OptimumBank Holdings, Inc. (OPHC): Price and Financial Metrics

OPHC Price/Volume Stats

| Current price | $4.46 | 52-week high | $4.91 |

| Prev. close | $4.46 | 52-week low | $2.85 |

| Day low | $4.45 | Volume | 1,234 |

| Day high | $4.46 | Avg. volume | 11,011 |

| 50-day MA | $4.38 | Dividend yield | N/A |

| 200-day MA | $4.05 | Market Cap | 42.97M |

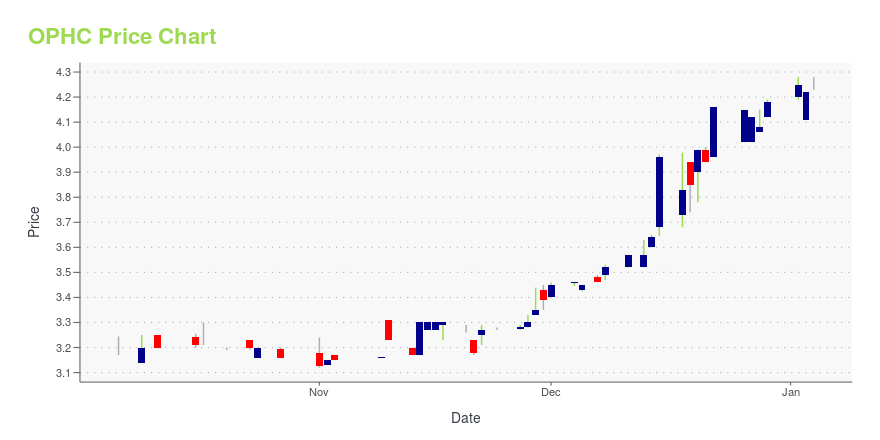

OPHC Stock Price Chart Interactive Chart >

OptimumBank Holdings, Inc. (OPHC) Company Bio

OptimumBank Holdings, Inc. operates as the bank holding company for OptimumBank that provides various consumer and commercial banking services to individuals and businesses. It accepts demand interest-bearing and noninterest-bearing, savings, money market, NOW, and time deposit accounts, as well as certificates of deposit; and offers residential and commercial real estate, multi-family real estate, commercial, land and construction, and consumer loans, as well as lending lines for working capital needs. The company also provides debit and ATM cards; investment, cash management, notary, and night depository services; and direct deposits, money orders, cashier's checks, domestic collections, and banking by mail, as well as Internet banking services. It operates through three banking offices located in Broward County, Florida. The company was founded in 2000 and is based in Fort Lauderdale, Florida.

Latest OPHC News From Around the Web

Below are the latest news stories about OPTIMUMBANK HOLDINGS INC that investors may wish to consider to help them evaluate OPHC as an investment opportunity.

OptimumBank Holdings, Inc. (OPHC-NASDAQ) Chairman Gubin’s comments pertaining to the Board’s Strategic Planning - “A successful roadmap for growing our Bank”Fort Lauderdale, FL, Dec. 08, 2023 (GLOBE NEWSWIRE) -- OptimumBank Holdings, Inc., (NASDAQ: OPHC) a (the “Company”) ended the month of October 2023 with assets exceeding $755.7 million, an increase of $43 million as compared to $712.7 million in the prior month. The net change in total assets was partially driven by a $26 million increase in net loans. Since the Company announced entry into Accounts Receivable Financing to Skilled Nursing Facilities at the end of last year, our SNF portfolio has |

OptimumBank Holdings, Inc. (OPHC-NASDAQ) Announces Third Quarter EarningsFort Lauderdale, FL, Nov. 09, 2023 (GLOBE NEWSWIRE) -- OptimumBank Holdings, Inc. (NASDAQ: OPHC) and subsidiary OptimumBank today announced the company’s total assets increased by approximately $128 million to $713 million as of September 30, 2023 from $585 million at December 31, 2022, primarily due to increases in loans, cash and cash equivalents. The growth in assets was attributable to the success of the Company’s efforts to increase loans that were funded by increased deposits from new cust |

Financial Services Virtual Investor Conference: Presentations Now Available for Online ViewingCompany Executives Share Vision and Answer Questions Live at VirtualInvestorConferences.comNEW YORK, Sept. 22, 2023 (GLOBE NEWSWIRE) -- Virtual Investor Conferences, the leading proprietary investor conference series, today announced the presentations from the Financial Services Virtual Investor Conference, held on September 21st are now available for online viewing. REGISTER NOW AT: https://bit.ly/3PM0Mkb The company presentations will be available 24/7 for 90 days. Investors, advisors, and ana |

Financial Services Virtual Investor Conference Agenda Announced for September 21stCompany Executives Share Vision and Answer Questions Live at VirtualInvestorConferences.comNEW YORK, Sept. 18, 2023 (GLOBE NEWSWIRE) -- Virtual Investor Conferences, the leading proprietary investor conference series, today announced the agenda for the Financial Services Virtual Investor Conference to be held on September 21st, 2023. Individual investors, institutional investors, advisors, and analysts are invited to attend. REGISTER NOW AT: https://bit.ly/44SP5N8 It is recommended that investor |

OptimumBank Holdings, Inc. (OPHC-NASDAQ) Announces Second Quarter EarningsFort Lauderdale, FL, Aug. 10, 2023 (GLOBE NEWSWIRE) -- OptimumBank Holdings, Inc. (NASDAQ: OPHC) and subsidiary OptimumBank today announced the company’s total assets increased by approximately $47 million to $633 million as of June 30, 2023 from $585 million at December 31, 2022, primarily due to increases in loans, and cash and cash equivalents. The growth in assets was attributable to the success of the Company’s efforts to increase loans and deposits from new customers. Net loans grew by $42 |

OPHC Price Returns

| 1-mo | 4.69% |

| 3-mo | 4.94% |

| 6-mo | -3.88% |

| 1-year | 41.59% |

| 3-year | -26.89% |

| 5-year | 31.18% |

| YTD | 6.65% |

| 2023 | 2.24% |

| 2022 | 4.07% |

| 2021 | 16.62% |

| 2020 | 21.66% |

| 2019 | N/A |

Continue Researching OPHC

Want to see what other sources are saying about OptimumBank Holdings Inc's financials and stock price? Try the links below:OptimumBank Holdings Inc (OPHC) Stock Price | Nasdaq

OptimumBank Holdings Inc (OPHC) Stock Quote, History and News - Yahoo Finance

OptimumBank Holdings Inc (OPHC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...