Opera Limited (OPRA): Price and Financial Metrics

OPRA Price/Volume Stats

| Current price | $11.75 | 52-week high | $18.35 |

| Prev. close | $11.78 | 52-week low | $10.30 |

| Day low | $11.59 | Volume | 419,800 |

| Day high | $11.91 | Avg. volume | 871,207 |

| 50-day MA | $13.52 | Dividend yield | 6.44% |

| 200-day MA | $12.92 | Market Cap | 1.04B |

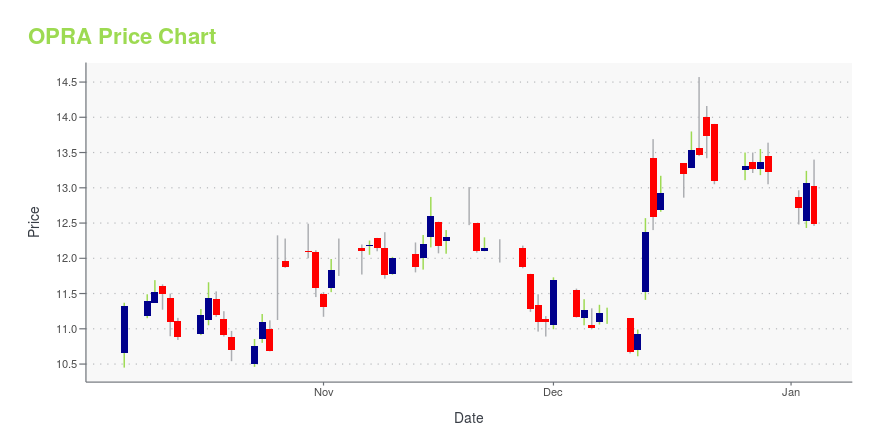

OPRA Stock Price Chart Interactive Chart >

Opera Limited (OPRA) Company Bio

Opera Limited is a leading provider of web browsers and digital content discovery platforms. The company was founded in 1995 and is based in Oslo, Norway.

Latest OPRA News From Around the Web

Below are the latest news stories about OPERA LTD that investors may wish to consider to help them evaluate OPRA as an investment opportunity.

Here's What We Like About Opera's (NASDAQ:OPRA) Upcoming DividendIt looks like Opera Limited ( NASDAQ:OPRA ) is about to go ex-dividend in the next 4 days. The ex-dividend date is one... |

3 Tech Stocks Set to Deliver Triple-Digit Gains in 2024These three overlooked tech stocks have triple-digit upside potential in 2024 as their valuations are disconnected from fundamentals. |

3 Overlooked Stocks With 10X Growth PotentialAre you looking to invest in overlooked stocks? |

7 Overlooked Growth Stocks Gearing Up for 10X GainsThese overlooked growth stocks have huge return potential and seem poised for massive rallies amid economic market hopes in 2024. |

Why Opera Stock Zoomed 13% Higher TodayGood financial results and a high-yield dividend keep bringing the bulls into the company. |

OPRA Price Returns

| 1-mo | -14.85% |

| 3-mo | -9.36% |

| 6-mo | 12.47% |

| 1-year | -27.36% |

| 3-year | 29.65% |

| 5-year | 16.27% |

| YTD | -5.83% |

| 2023 | 114.94% |

| 2022 | -10.91% |

| 2021 | -22.67% |

| 2020 | -1.30% |

| 2019 | 66.37% |

OPRA Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching OPRA

Want to do more research on Opera Ltd's stock and its price? Try the links below:Opera Ltd (OPRA) Stock Price | Nasdaq

Opera Ltd (OPRA) Stock Quote, History and News - Yahoo Finance

Opera Ltd (OPRA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...