Orange ADR (ORAN): Price and Financial Metrics

ORAN Price/Volume Stats

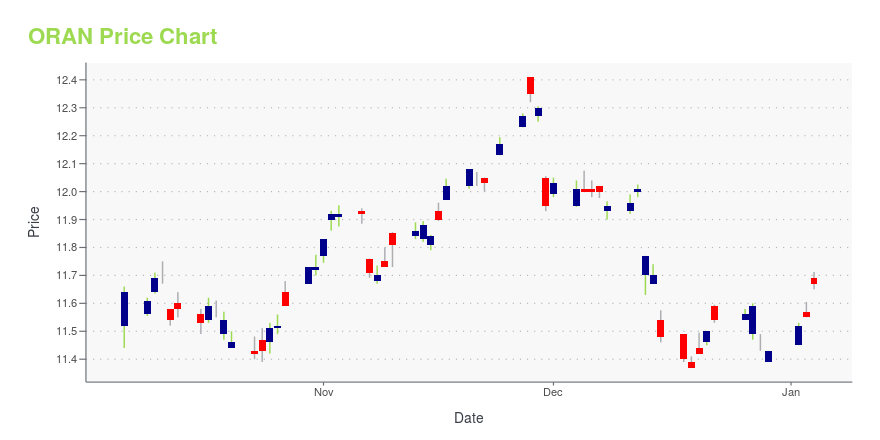

| Current price | $11.17 | 52-week high | $12.41 |

| Prev. close | $11.11 | 52-week low | $9.82 |

| Day low | $11.11 | Volume | 296,477 |

| Day high | $11.18 | Avg. volume | 457,995 |

| 50-day MA | $10.86 | Dividend yield | 6.58% |

| 200-day MA | $11.45 | Market Cap | 29.69B |

ORAN Stock Price Chart Interactive Chart >

Orange ADR (ORAN) Company Bio

Orange S.A. (French pronunciation: [ɔʁɑ̃ʒ ɛs ɑ]), formerly France Télécom S.A. (stylized as france telecom) is a French multinational telecommunications corporation. It has 266 million customers worldwide and employs 89,000 people in France, and 59,000 elsewhere. In 2015, the group had revenue of €40 billion. The company's head office is located in the 15th arrondissement of Paris. (Source:Wikipedia)

Latest ORAN News From Around the Web

Below are the latest news stories about ORANGE that investors may wish to consider to help them evaluate ORAN as an investment opportunity.

Press Release Orange: Transactions carried out as part of a share buyback program and outside of a liquidity contractPress releaseParis, 14th December 2023 Transactions carried out as part of a share buyback program and outside of a liquidity contract Orange announces that it has purchased treasury shares within the framework of its 2023 share buyback program. These shares have been acquired to honour obligations related to long-term incentive plans for corporate officers and senior employees. The long-term incentive plans, which are conditional on presence and performance, were set up with the aim of involvin |

Total number of shares and voting rights at November 30, 20236 December 2023 Orange: information on the total number of shares and voting rights referred to in Article L.233-8 II of the French Commercial Code and Article 223-16 of the General Regulations of the Autorité des Marchés Financiers. In application of Article L. 22-10-46 of the French Commercial Code (Code de commerce), as from 3 April 2016, a double voting right is automatically granted to fully paid-up shares that have been held in registered form and under a single shareholder name for at lea |

A Reclusive Romanian Tycoon Is Betting Big on European Broadband(Bloomberg) -- Romanian tycoon Zoltan Teszari, one of the country’s richest people, keeps such a low profile that local newspapers are often forced to use 20-year-old photographs of the multimillionaire. Most Read from BloombergHow Suspects Laundered Billions in Singapore for YearsMoody’s Cuts China Credit Outlook to Negative on Rising DebtTreasury Yields Fall With Economic Data in Focus: Markets WrapHarvard Alumni Rebuke Its Israel Response With Mere $1 DonationsPutin’s Gulf Visit Defies Effort |

20 Largest Telecom Companies in The World by RevenueIn this article, we will take a look at 20 largest telecom companies in the world by revenue. If you want to skip our detailed analysis, you can go directly to 5 Largest Telecom Companies in The World by Revenue. According to a report by Grandview Research, the global telecom services market was valued at […] |

Orange Business and VMware Transform Flexible SD-WAN to Simplify Customer Experience With Digitalization and AutomationPARIS & BARCELONA, Spain, November 08, 2023--Orange Business and VMware, Inc. (NYSE: VMW) are strengthening their partnership to deliver Flexible SD-WAN with VMware as the first fully embedded SD-WAN offering in Evolution Platform. The Orange Business Evolution Platform combines a secured digital infrastructure with an agile, cloud approach to order and manage services. |

ORAN Price Returns

| 1-mo | 11.59% |

| 3-mo | 3.51% |

| 6-mo | -5.41% |

| 1-year | 2.57% |

| 3-year | 13.71% |

| 5-year | -3.11% |

| YTD | 0.80% |

| 2023 | 21.40% |

| 2022 | -1.48% |

| 2021 | -5.23% |

| 2020 | -15.31% |

| 2019 | -6.29% |

ORAN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching ORAN

Want to do more research on Orange's stock and its price? Try the links below:Orange (ORAN) Stock Price | Nasdaq

Orange (ORAN) Stock Quote, History and News - Yahoo Finance

Orange (ORAN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...