Owl Rock Capital Corporation (ORCC): Price and Financial Metrics

ORCC Price/Volume Stats

| Current price | $13.48 | 52-week high | $13.88 |

| Prev. close | $13.50 | 52-week low | $10.18 |

| Day low | $13.39 | Volume | 1,636,100 |

| Day high | $13.55 | Avg. volume | 1,752,750 |

| 50-day MA | $13.20 | Dividend yield | 9.79% |

| 200-day MA | $12.59 | Market Cap | 5.25B |

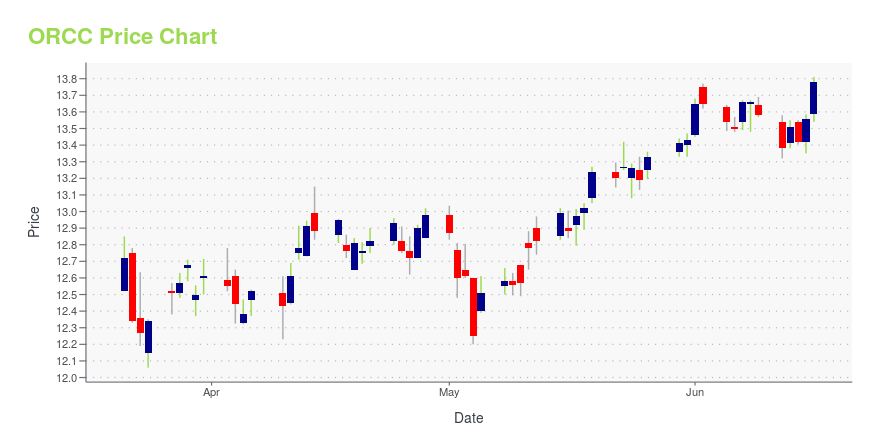

ORCC Stock Price Chart Interactive Chart >

Owl Rock Capital Corporation (ORCC) Company Bio

Owl Rock Capital Corporation provides asset management services. The Company offers investment strategy, direct lending solutions, acquisitions, recapitalization, and other related as activities. Owl Rock Capital serves customers in the State of New York.

Latest ORCC News From Around the Web

Below are the latest news stories about OWL ROCK CAPITAL CORP that investors may wish to consider to help them evaluate ORCC as an investment opportunity.

Blue Owl Capital Corporation Schedules Earnings Release and Quarterly Earnings Call to Discuss its Second Quarter Ended June 30, 2023 Financial ResultsBlue Owl Capital Corporation (NYSE: OBDC) ("OBDC"), formerly known as Owl Rock Capital Corporation, today announced it will release its financial results for the second quarter ended June 30, 2023 on Wednesday, August 9, 2023 after market close. OBDC invites all interested persons to its webcast / conference call on Thursday, August 10, 2023 at 10:00 a.m. Eastern Time to discuss its second quarter ended June 30, 2023 financial results. |

Owl Rock Capital Corporation Renamed to Blue Owl Capital CorporationEffective today, Owl Rock Capital Corporation is renamed to Blue Owl Capital Corporation (the "Company") and, beginning with today's trading session, its ticker symbol on the New York Stock Exchange will be "OBDC". CUSIPs for the equity and unsecured notes of the Company will not change and its outstanding unsecured notes will also trade under "OBDC". Additionally, the Company's new website address is www.blueowlcapitalcorporation.com. The Company's day-to-day business remains unchanged. |

Owl Rock BDCs RenamedAs previously announced on June 22, 2023, the Owl Rock BDCs (as listed in the chart below) have been renamed effective today. The new names and websites for each entity can be found below. Additionally, beginning with today's trading session, Blue Owl Capital Corporation, formerly Owl Rock Capital Corporation, will be "OBDC" on the New York Stock Exchange. New unsecured notes tickers, to the extent applicable, are also included below. |

Owl Rock Capital Corporation Announces Upcoming Name and Ticker Change to Blue Owl Capital CorporationOwl Rock Capital Corporation (NYSE: ORCC, or the "Company") today announced that it will soon be changing its name, ticker, and website. The Company's board of directors has already approved these changes and no shareholder vote is required. |

Insiders Load Up on These 2 Dividend Stocks With Impressive Yields of 8% or MoreSaying ‘insider trading’ conjures up images of smoky back rooms and shady deals, but that’s only for the movies. In real life, insiders refer to corporate officers, such as CEOs, CFOs, COOs, and directors, who are responsible for running their companies profitably. They don’t take trading their own companies’ stocks lightly. While they may sell for various reasons, they only buy when they anticipate a rise in the share price. That makes the insiders’ trading moves one of the surest signs that in |

ORCC Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | 14.31% |

| 5-year | 31.18% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -9.48% |

| 2021 | 21.99% |

| 2020 | -19.52% |

| 2019 | N/A |

ORCC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...