Micromidas, Inc., (ORGN): Price and Financial Metrics

ORGN Price/Volume Stats

| Current price | $0.91 | 52-week high | $4.53 |

| Prev. close | $0.93 | 52-week low | $0.44 |

| Day low | $0.91 | Volume | 432,570 |

| Day high | $0.96 | Avg. volume | 1,914,610 |

| 50-day MA | $0.97 | Dividend yield | N/A |

| 200-day MA | $0.81 | Market Cap | 134.42M |

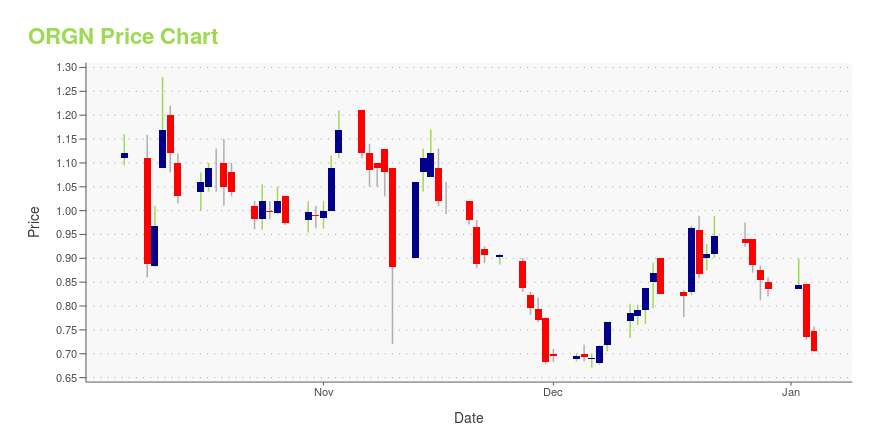

ORGN Stock Price Chart Interactive Chart >

Micromidas, Inc., (ORGN) Company Bio

Micromidas, Inc., doing business as Origin Materials, produces and commercializes plant-based PET plastic. It develops a platform for turning the carbon found in biomass into useful materials, while capturing carbon in the process. The company serves tire filler, carbon black, agriculture, and activated carbon markets. Micromidas, Inc. was incorporated in 2008 and is based in West Sacramento, California with a facility in Sarnia, Canada.

Latest ORGN News From Around the Web

Below are the latest news stories about ORIGIN MATERIALS INC that investors may wish to consider to help them evaluate ORGN as an investment opportunity.

AVGO, VMW Stocks Slide as Broadcom-VMware Deal NearsBroadcom and VMware stocks are falling on Tuesday as AVGO and VMW shareholders prepare for the company's to merge tomorrow. |

Is the Stock Market Closed on Black Friday 2023?Investors who are wondering if the stock market is closed on Black Friday will want to keep reading as we have the answer to that question! |

Origin Materials Layoffs 2023: What to Know About the Latest ORGN Job CutsOrigin Materials layoffs have the company cutting 30% of its workforce as it plans to switch focus with a major restructuring. |

Why Are Stocks Down Today?Stocks are down on Tuesday as investors wait for the minutes from the Federal Reserve meeting to be published later today. |

Origin Materials Announces Organizational Streamlining to Support Priority InitiativesWEST SACRAMENTO, Calif., November 20, 2023--Origin Materials, Inc. ("Origin," "Origin Materials," or the "Company") (NASDAQ: ORGN, ORGNW), the world’s leading carbon negative materials company with a mission to enable the world’s transition to sustainable materials, today announced an organizational realignment that reflects the acceleration of higher margin revenue opportunities and the deferral of research programs with strong, but longer-term economic impacts. |

ORGN Price Returns

| 1-mo | -8.07% |

| 3-mo | 29.17% |

| 6-mo | 41.86% |

| 1-year | -78.33% |

| 3-year | -85.69% |

| 5-year | N/A |

| YTD | 8.83% |

| 2023 | -81.86% |

| 2022 | -28.53% |

| 2021 | -39.32% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...