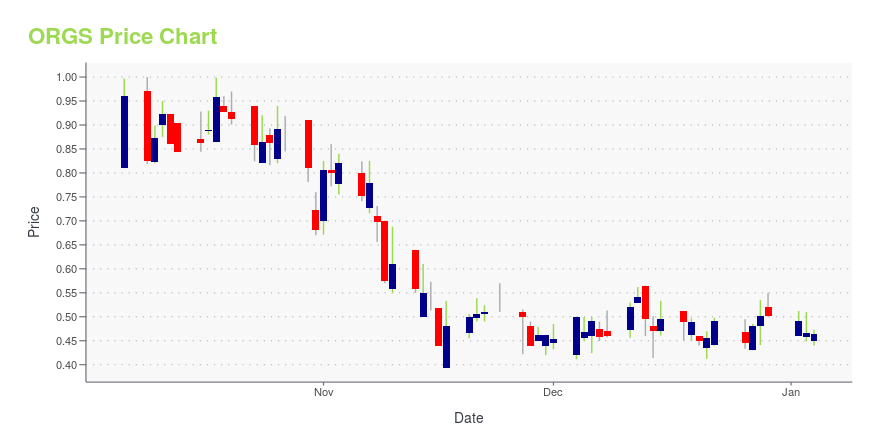

Orgenesis Inc. (ORGS): Price and Financial Metrics

ORGS Price/Volume Stats

| Current price | $0.54 | 52-week high | $1.17 |

| Prev. close | $0.62 | 52-week low | $0.25 |

| Day low | $0.52 | Volume | 150,900 |

| Day high | $0.65 | Avg. volume | 162,135 |

| 50-day MA | $0.58 | Dividend yield | N/A |

| 200-day MA | $0.57 | Market Cap | 18.60M |

ORGS Stock Price Chart Interactive Chart >

Orgenesis Inc. (ORGS) Company Bio

Orgenesis Inc., a service and research company, focus on the development and manufacture of cell therapy for advanced medicinal products in the field of regenerative medicine industry. The company was founded in 2008 and is based in Germantown, Maryland.

Latest ORGS News From Around the Web

Below are the latest news stories about ORGENESIS INC that investors may wish to consider to help them evaluate ORGS as an investment opportunity.

Analysts Expect Orgenesis Inc. (NASDAQ:ORGS) To Breakeven SoonOrgenesis Inc. ( NASDAQ:ORGS ) is possibly approaching a major achievement in its business, so we would like to shine... |

Orgenesis Ranked No. 171st Fastest-Growing Company in North America on the 2023 Deloitte Technology Fast 500 TMGERMANTOWN, Md., Nov. 14, 2023 (GLOBE NEWSWIRE) -- Orgenesis Inc. (NASDAQ: ORGS) (“Orgenesis” or the “Company”), a global biotech company working to unlock the full potential of cell and gene therapies (CGT), today announced it ranked 171 on the Deloitte Technology Fast 500™, a ranking of the fastest-growing technology, media, telecommunications, life sciences, fintech, and energy tech companies in North America, now in its 29th year. Vered Caplan, CEO of Orgenesis, commented, “We are very proud |

Orgenesis Provides Business Update for the Third Quarter of 2023Advances rollout of POCare Platform and POCare TherapiesGERMANTOWN, Md., Nov. 13, 2023 (GLOBE NEWSWIRE) -- Orgenesis Inc. (NASDAQ: ORGS) (“Orgenesis” or the “Company”), a global biotech company working to unlock the full potential of cell and gene therapies (CGT), today provided a business update for the third quarter ended September 30, 2023. Vered Caplan, CEO of Orgenesis, said, “We continue to advance the commercial launch of our POCare Platform through Octomera, building out a decentralized |

Orgenesis Inc. Announces Pricing of $1.1 Million Registered Direct OfferingGERMANTOWN, Md., Nov. 08, 2023 (GLOBE NEWSWIRE) -- Orgenesis Inc. (“Orgenesis”) (Nasdaq: ORGS), a global biotech company working to unlock the full potential of cell and gene therapies (CGTs), announced today that it has entered into a securities purchase agreement with a single institutional investor to purchase approximately $1.1 million of its common stock and warrants to purchase common stock in a registered direct offering. The combined effective purchase price for each share of common stoc |

Orgenesis Announces Expanded Partnership Between Octomera and UC Davis Through CIRM Grant FundingGERMANTOWN, Md., Nov. 02, 2023 (GLOBE NEWSWIRE) -- Orgenesis Inc. (NASDAQ: ORGS) (“Orgenesis” or the “Company”), a global biotech company working to unlock the full potential of cell and gene therapies (CGTs), today announced continued progression of the Point of Care (POCare) network and infrastructure for the advanced therapeutic services and facilities business through its subsidiary Octomera. The teams have been confirmed as an industrial partner to the University of California Davis, a lead |

ORGS Price Returns

| 1-mo | -8.47% |

| 3-mo | 6.49% |

| 6-mo | 73.91% |

| 1-year | -50.91% |

| 3-year | -88.70% |

| 5-year | -88.24% |

| YTD | 7.85% |

| 2023 | -74.32% |

| 2022 | -32.29% |

| 2021 | -36.00% |

| 2020 | -3.43% |

| 2019 | -0.43% |

Loading social stream, please wait...