OneSpaWorld Holdings Limited (OSW): Price and Financial Metrics

OSW Price/Volume Stats

| Current price | $16.62 | 52-week high | $17.25 |

| Prev. close | $16.52 | 52-week low | $9.82 |

| Day low | $16.46 | Volume | 390,500 |

| Day high | $16.77 | Avg. volume | 584,301 |

| 50-day MA | $15.54 | Dividend yield | N/A |

| 200-day MA | $13.48 | Market Cap | 1.67B |

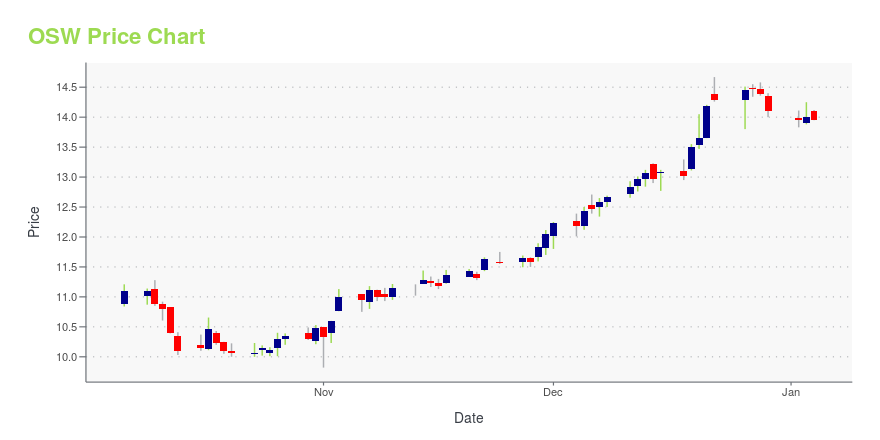

OSW Stock Price Chart Interactive Chart >

OneSpaWorld Holdings Limited (OSW) Company Bio

OneSpaWorld Holdings Limited operates as a holding company. The Company, through its subsidiaries, provides a range of health, fitness, beauty, and wellness services. OneSpaWorld Holdings serves customers worldwide.

Latest OSW News From Around the Web

Below are the latest news stories about ONESPAWORLD HOLDINGS LTD that investors may wish to consider to help them evaluate OSW as an investment opportunity.

OneSpaWorld (OSW) Just Flashed Golden Cross Signal: Do You Buy?Is it a good or bad thing when a stock experiences a golden cross technical event? |

Is OneSpaWorld Holdings Limited (NASDAQ:OSW) Trading At A 50% Discount?Key Insights The projected fair value for OneSpaWorld Holdings is US$25.25 based on 2 Stage Free Cash Flow to Equity... |

Check-In for Profits: 3 Hotel Stocks Poised for GrowthWant exposure to the hospitality industry as it continues to grow? |

Why OneSpaWorld (OSW) Might be Well Poised for a SurgeOneSpaWorld (OSW) shares have started gaining and might continue moving higher in the near term, as indicated by solid earnings estimate revisions. |

Does OneSpaWorld (OSW) Have the Potential to Rally 32.76% as Wall Street Analysts Expect?The mean of analysts' price targets for OneSpaWorld (OSW) points to a 32.8% upside in the stock. While this highly sought-after metric has not proven reasonably effective, strong agreement among analysts in raising earnings estimates does indicate an upside in the stock. |

OSW Price Returns

| 1-mo | 9.49% |

| 3-mo | 30.05% |

| 6-mo | 24.31% |

| 1-year | 35.23% |

| 3-year | 77.94% |

| 5-year | 4.45% |

| YTD | 17.87% |

| 2023 | 51.13% |

| 2022 | -6.89% |

| 2021 | -1.18% |

| 2020 | -39.64% |

| 2019 | N/A |

Loading social stream, please wait...