Otis Worldwide Corp. (OTIS): Price and Financial Metrics

OTIS Price/Volume Stats

| Current price | $93.48 | 52-week high | $100.84 |

| Prev. close | $93.03 | 52-week low | $73.32 |

| Day low | $91.79 | Volume | 2,466,000 |

| Day high | $94.01 | Avg. volume | 2,103,924 |

| 50-day MA | $97.19 | Dividend yield | 1.59% |

| 200-day MA | $91.57 | Market Cap | 37.80B |

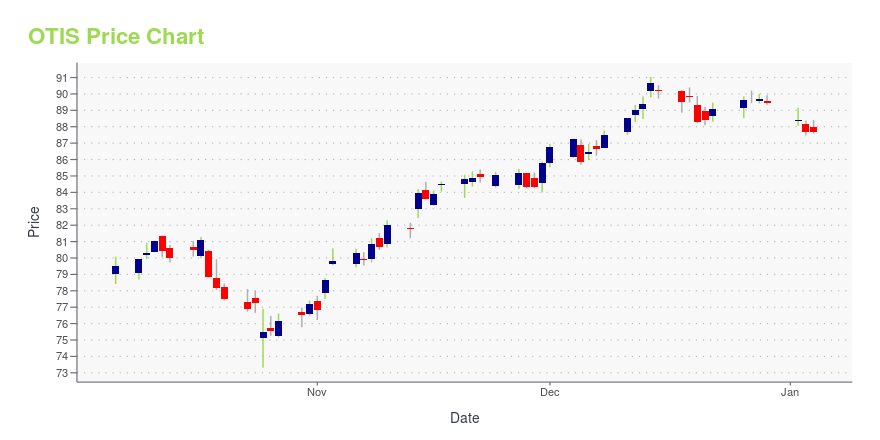

OTIS Stock Price Chart Interactive Chart >

Otis Worldwide Corp. (OTIS) Company Bio

Otis Worldwide Corporation (branded as the Otis Elevator Company, its former legal name) is an American company that develops, manufactures and markets elevators, escalators, moving walkways, and related equipment. (Source:Wikipedia)

Latest OTIS News From Around the Web

Below are the latest news stories about OTIS WORLDWIDE CORP that investors may wish to consider to help them evaluate OTIS as an investment opportunity.

3 Urbanization Stocks to Capitalize on City Growth in 2024The world continues to see more people living in cities. |

Otis to Host 2024 Investor DayOtis Worldwide Corporation (NYSE: OTIS) will host its 2024 Investor Day on Thursday, February 15, 2024, in New York City. Otis Chair, CEO & President Judy Marks and members of the leadership team will discuss the company's strategic initiatives and medium-term financial outlook. |

AZEK to Report Solid Q4 Earnings on Strong Residential UnitAZEK's operational excellence, sourcing savings and recycling initiatives and lower raw material costs are likely to aid its fiscal fourth-quarter performance. |

Otis Worldwide (OTIS) Up 12.5% Since Last Earnings Report: Can It Continue?Otis Worldwide (OTIS) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

OTIS Benefits From R&D Investments, Solid Backlog LevelOTIS benefits from robust R&D investments and operational improvements, reflecting solid backlog and order volume. |

OTIS Price Returns

| 1-mo | -2.63% |

| 3-mo | 1.80% |

| 6-mo | 5.47% |

| 1-year | 5.47% |

| 3-year | 11.00% |

| 5-year | N/A |

| YTD | 5.30% |

| 2023 | 16.04% |

| 2022 | -8.76% |

| 2021 | 30.41% |

| 2020 | N/A |

| 2019 | N/A |

OTIS Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...