Penske Automotive Group, Inc. (PAG): Price and Financial Metrics

PAG Price/Volume Stats

| Current price | $160.56 | 52-week high | $177.34 |

| Prev. close | $158.56 | 52-week low | $137.95 |

| Day low | $158.52 | Volume | 186,500 |

| Day high | $161.51 | Avg. volume | 192,471 |

| 50-day MA | $151.60 | Dividend yield | 2.49% |

| 200-day MA | $152.53 | Market Cap | 10.74B |

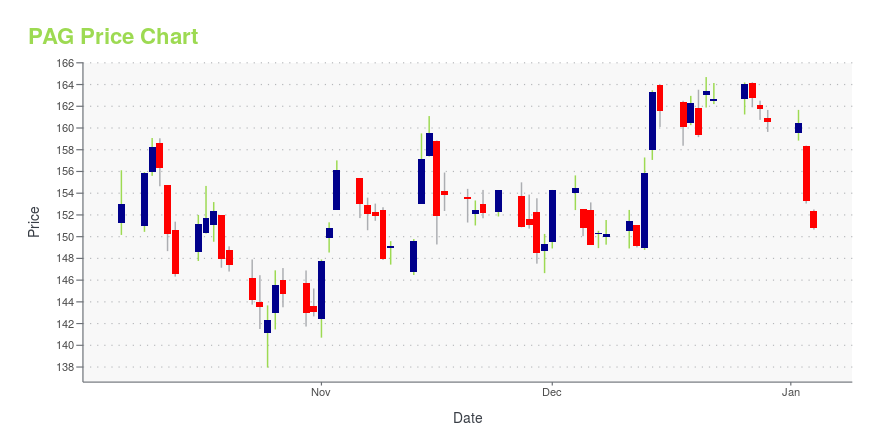

PAG Stock Price Chart Interactive Chart >

Penske Automotive Group, Inc. (PAG) Company Bio

Penske Automotive Group is an international transportation services company that operates automotive and commercial truck dealerships principally in the United States and Western Europe, and distributes commercial vehicles, diesel engines, gas engines, power systems and related parts and services principally in Australia and New Zealand. The company is based in Bloomfield Hills, Michigan.

Latest PAG News From Around the Web

Below are the latest news stories about PENSKE AUTOMOTIVE GROUP INC that investors may wish to consider to help them evaluate PAG as an investment opportunity.

Auto Roundup: GM's Cruise Layoff Update, BLBD's Quarterly Release & MoreWhile General Motors' Cruise trims its workforce by 24%, Blue Bird (BLBD) delivers a comprehensive beat for the fiscal fourth quarter of 2023 and raises fiscal 2024 forecasts. |

Penske (PAG) to Buy Rybrook Group in the United KingdomPenske (PAG) signs a deal to acquire Rybrook Group Limited to expand its footprint in the United Kingdom. |

PENSKE AUTOMOTIVE GROUP TO EXPAND PRESENCE IN THE UNITED KINGDOMPenske Automotive Group, Inc. (NYSE: PAG), a diversified international transportation services company and one of the world's premier automotive and commercial truck retailers, today announced that it has agreed to acquire Rybrook Group Limited consisting of 15 premium dealerships in the United Kingdom, including four BMW dealerships, four MINI dealerships, four Volvo dealerships, two Land Rover dealerships and one Porsche dealership. Additionally, three of the BMW locations also retail BMW Moto |

Value Picks: 3 Undervalued Stocks Ready to ReboundBefore getting into a discussion about value stocks, it’s important to point out what the label isn’t. |

Why Is Penske (PAG) Up 4.6% Since Last Earnings Report?Penske (PAG) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

PAG Price Returns

| 1-mo | 8.40% |

| 3-mo | 3.79% |

| 6-mo | 5.97% |

| 1-year | 0.58% |

| 3-year | 110.52% |

| 5-year | 282.72% |

| YTD | 1.22% |

| 2023 | 42.29% |

| 2022 | 9.22% |

| 2021 | 84.36% |

| 2020 | 20.12% |

| 2019 | 28.91% |

PAG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PAG

Here are a few links from around the web to help you further your research on Penske Automotive Group Inc's stock as an investment opportunity:Penske Automotive Group Inc (PAG) Stock Price | Nasdaq

Penske Automotive Group Inc (PAG) Stock Quote, History and News - Yahoo Finance

Penske Automotive Group Inc (PAG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...