PagSeguro Digital Ltd. Cl A (PAGS): Price and Financial Metrics

PAGS Price/Volume Stats

| Current price | $13.35 | 52-week high | $14.98 |

| Prev. close | $13.20 | 52-week low | $6.93 |

| Day low | $13.25 | Volume | 2,279,100 |

| Day high | $13.52 | Avg. volume | 3,090,066 |

| 50-day MA | $12.29 | Dividend yield | N/A |

| 200-day MA | $11.77 | Market Cap | 4.40B |

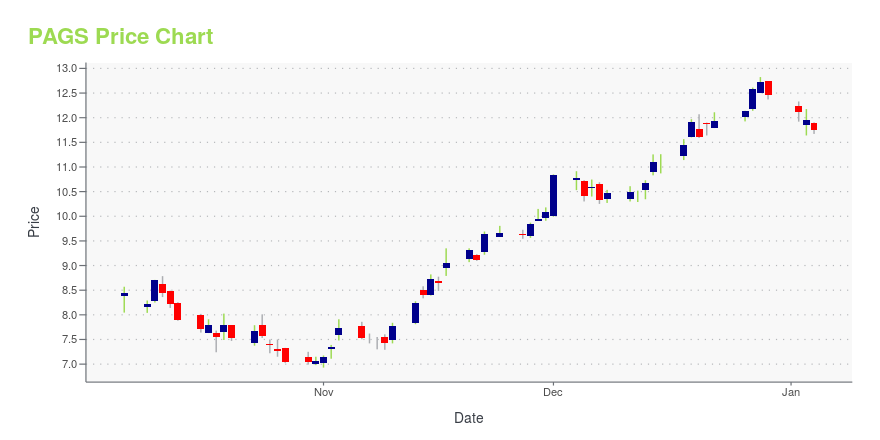

PAGS Stock Price Chart Interactive Chart >

PagSeguro Digital Ltd. Cl A (PAGS) Company Bio

PagSeguro is a financial services and digital payments company based in São Paulo, Brazil and incorporated in the Grand Cayman, Cayman Islands. Founded in 2006, the company primarily offers payment processing software for e-commerce websites and mobile applications, and point of sale terminals. It has been traded as a public company on the New York Stock Exchange since January 2018 with the ticker symbol (Source:Wikipedia)

Latest PAGS News From Around the Web

Below are the latest news stories about PAGSEGURO DIGITAL LTD that investors may wish to consider to help them evaluate PAGS as an investment opportunity.

As PagSeguro Digital (NYSE:PAGS) jumps 12% this past week, investors may now be noticing the company's three-year earnings growthOver the last month the PagSeguro Digital Ltd. ( NYSE:PAGS ) has been much stronger than before, rebounding by 40%. But... |

Warren Buffett Stocks Among Six Fintechs Near Buy PointsBrazil-focused fintechs, including two backed by Warren Buffett, are thriving amid a strong economy, internet user growth and the unbanked. |

Q3 2023 PagSeguro Digital Ltd Earnings CallQ3 2023 PagSeguro Digital Ltd Earnings Call |

12 Tech Stocks with Low PE RatiosIn this article, we present 12 tech stocks with low PE ratios. To skip the detailed analysis of the technology sector, go directly to the 5 Tech Stocks with low PE ratios. Technology stocks faced a heavy beat down in 2022 and were one of the worst-performing sectors of the year. Two of the US […] |

Zacks Value Trader Highlights: Wells Fargo, Toll Brothers, Skechers, JD.com and PagSeguro DigitalWells Fargo, Toll Brothers, Skechers, JD.com and PagSeguro Digital are part of the Zacks Value Trader blog. |

PAGS Price Returns

| 1-mo | 13.23% |

| 3-mo | 5.28% |

| 6-mo | -2.27% |

| 1-year | 22.93% |

| 3-year | -75.71% |

| 5-year | -71.75% |

| YTD | 7.06% |

| 2023 | 42.68% |

| 2022 | -66.67% |

| 2021 | -53.90% |

| 2020 | 66.51% |

| 2019 | 82.38% |

Continue Researching PAGS

Here are a few links from around the web to help you further your research on PagSeguro Digital Ltd's stock as an investment opportunity:PagSeguro Digital Ltd (PAGS) Stock Price | Nasdaq

PagSeguro Digital Ltd (PAGS) Stock Quote, History and News - Yahoo Finance

PagSeguro Digital Ltd (PAGS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...