Patriot Transportation Holding, Inc. (PATI): Price and Financial Metrics

PATI Price/Volume Stats

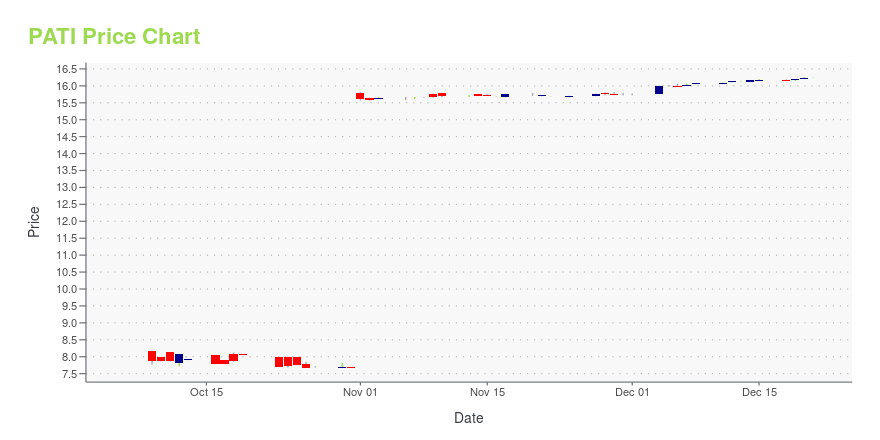

| Current price | $16.26 | 52-week high | $16.26 |

| Prev. close | $16.25 | 52-week low | $6.95 |

| Day low | $16.25 | Volume | 19,300 |

| Day high | $16.26 | Avg. volume | 9,131 |

| 50-day MA | $13.60 | Dividend yield | N/A |

| 200-day MA | $9.90 | Market Cap | 57.79M |

PATI Stock Price Chart Interactive Chart >

Patriot Transportation Holding, Inc. (PATI) Company Bio

Patriot Transportation Holding, Inc., through its subsidiary, Florida Rock & Tank Lines, Inc., transports petroleum and other liquids, and dry bulk commodities. The company is involved in hauling petroleum related products, including gas and diesel fuel; and dry bulk commodities, such as cement, lime, and various industrial powder products, as well as liquid chemicals. Its petroleum clients include convenience stores and hypermarket accounts, fuel wholesalers, and oil companies; and dry bulk and chemical customers comprise industrial companies, such as cement and concrete accounts, as well as product distribution companies. As of September 30, 2020, the company operated a fleet of 320 company tractors, 18 owner operators, and 444 trailers from its 18 terminals and 6 satellite locations in Florida, Georgia, Alabama, and Tennessee. Patriot Transportation Holding, Inc. is headquartered in Jacksonville, Florida.

Latest PATI News From Around the Web

Below are the latest news stories about PATRIOT TRANSPORTATION HOLDING INC that investors may wish to consider to help them evaluate PATI as an investment opportunity.

United Petroleum Transports and Patriot Transportation Holding Conclude AcquisitionOKLAHOMA CITY, OK / ACCESSWIRE / December 21, 2023 / United Petroleum Transports, Inc. (UPT) and Patriot Transportation Holding, Inc. (Patriot), closed on UPT's previously announced acquisition of Patriot and its wholly owned subsidiary, Florida Rock ... |

Patriot Transportation Holding, Inc. Announces Results for the Fourth Quarter and Fiscal Year 2023JACKSONVILLE, FL / ACCESSWIRE / December 6, 2023 / Patriot Transportation Holding, Inc. (NASDAQ:PATI)Fourth Quarter Operating ResultsThe Company reported net income of $526,000, or $.15 per share for the quarter ended September 30, 2023, compared ... |

Patriot Transportation and United Petroleum Transports to CombinePatriot Transportation Shareholders to Receive $16.26 per Share in CashJACKSONVILLE, FL / ACCESSWIRE / November 1, 2023 / Patriot Transportation Holding, Inc. (NASDAQ:PATI) ("Patriot" or the "Company"), today announced an agreement under which United ... |

Returns Are Gaining Momentum At Patriot Transportation Holding (NASDAQ:PATI)If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an... |

Calculating The Fair Value Of Patriot Transportation Holding, Inc. (NASDAQ:PATI)Key Insights The projected fair value for Patriot Transportation Holding is US$9.53 based on 2 Stage Free Cash Flow to... |

PATI Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 97.33% |

| 3-year | 37.80% |

| 5-year | N/A |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -12.89% |

| 2021 | -8.09% |

| 2020 | -28.11% |

| 2019 | -1.17% |

Continue Researching PATI

Want to see what other sources are saying about Patriot Transportation Holding Inc's financials and stock price? Try the links below:Patriot Transportation Holding Inc (PATI) Stock Price | Nasdaq

Patriot Transportation Holding Inc (PATI) Stock Quote, History and News - Yahoo Finance

Patriot Transportation Holding Inc (PATI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...