PAVmed Inc. (PAVM): Price and Financial Metrics

PAVM Price/Volume Stats

| Current price | $0.75 | 52-week high | $2.43 |

| Prev. close | $0.77 | 52-week low | $0.57 |

| Day low | $0.71 | Volume | 104,800 |

| Day high | $0.77 | Avg. volume | 196,897 |

| 50-day MA | $0.70 | Dividend yield | N/A |

| 200-day MA | $0.91 | Market Cap | 12.59M |

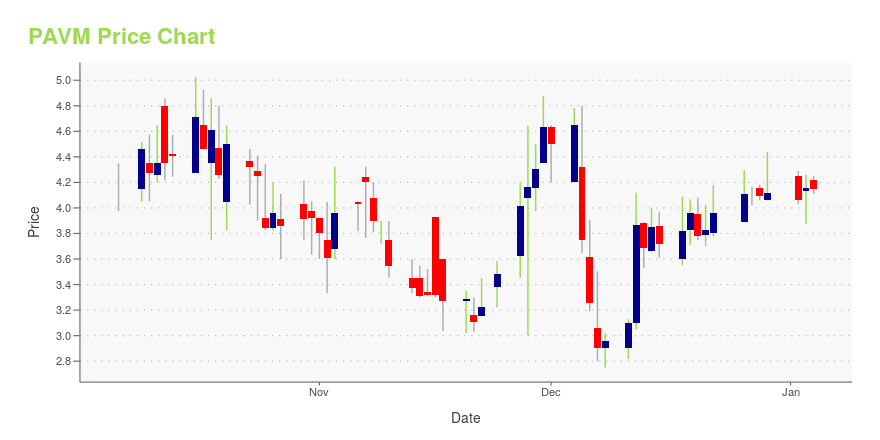

PAVM Stock Price Chart Interactive Chart >

PAVmed Inc. (PAVM) Company Bio

PAVmed Inc. operates as a medical device company in the United States. Its product pipeline includes PortIO, a long-term implantable vascular access device; CarpX, a percutaneous device to treat carpal tunnel syndrome; NextCath, a self-anchoring catheter; DisappEAR: Antibiotic-eluting resorbable ear tube; NextFlo, a disposable infusion pump; and Caldus, a disposable tissue ablation device. The company was formerly known as PAXmed Inc. and changed its name to PAVmed Inc. in April 2015. PAVmed Inc. was founded in 2014 and is based in New York, New York.

PAVM Price Returns

| 1-mo | -3.97% |

| 3-mo | 15.74% |

| 6-mo | -39.02% |

| 1-year | N/A |

| 3-year | -96.53% |

| 5-year | -97.25% |

| YTD | 19.52% |

| 2024 | -84.77% |

| 2023 | -42.78% |

| 2022 | -80.49% |

| 2021 | 16.04% |

| 2020 | 76.67% |

Loading social stream, please wait...