PB Bankshares, Inc. (PBBK): Price and Financial Metrics

PBBK Price/Volume Stats

| Current price | $15.48 | 52-week high | $15.50 |

| Prev. close | $15.30 | 52-week low | $11.71 |

| Day low | $15.38 | Volume | 2,800 |

| Day high | $15.50 | Avg. volume | 3,398 |

| 50-day MA | $13.66 | Dividend yield | N/A |

| 200-day MA | $12.87 | Market Cap | 40.37M |

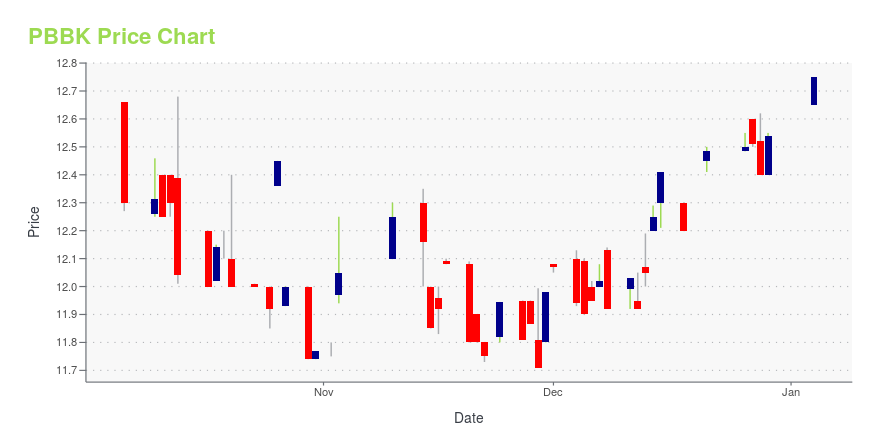

PBBK Stock Price Chart Interactive Chart >

PB Bankshares, Inc. (PBBK) Company Bio

PB Bankshares, Inc. focuses on operating as a holding company for the Prosper Bank that provides various financial products and services in Pennsylvania. The company accepts various deposits, including demand deposit accounts, savings accounts, money market accounts, and certificate of deposit accounts. It also provides one- to four-family residential real estate, commercial real estate, commercial and industrial, construction, and consumer loans, as well as home equity lines of credit. In addition, the company offers remote deposit capture, commercial cash management, and mobile deposits, as well as online and mobile banking services; and invests in various securities. It operates through a network of four branch offices and one loan production office in Chester, Lancaster, and Dauphin Counties, Pennsylvania. PB Bankshares, Inc. was founded in 1919 and is based in Coatesville, Pennsylvania.

Latest PBBK News From Around the Web

Below are the latest news stories about PB BANKSHARES INC that investors may wish to consider to help them evaluate PBBK as an investment opportunity.

PB Bankshares Inc (NASDAQ:PBBK) Short Interest Down 22.2% in NovemberPB Bankshares Inc (NASDAQ:PBBK) was the target of a significant drop in short interest in the month of November. As of November 30th, there was short interest totalling 7,700 shares, a drop of 22.2% from the November 15th total of 9,900 shares. Based on an average trading volume of 6,100 shares, the days-to-cover ratio is [] |

PBBK Price Returns

| 1-mo | N/A |

| 3-mo | 27.30% |

| 6-mo | 15.52% |

| 1-year | 16.83% |

| 3-year | 19.35% |

| 5-year | N/A |

| YTD | 23.44% |

| 2023 | -7.66% |

| 2022 | -0.07% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...