PBF Energy Inc. (PBF): Price and Financial Metrics

PBF Price/Volume Stats

| Current price | $40.46 | 52-week high | $62.88 |

| Prev. close | $40.24 | 52-week low | $37.62 |

| Day low | $39.65 | Volume | 1,837,900 |

| Day high | $40.75 | Avg. volume | 2,045,278 |

| 50-day MA | $44.41 | Dividend yield | 2.62% |

| 200-day MA | $47.86 | Market Cap | 4.80B |

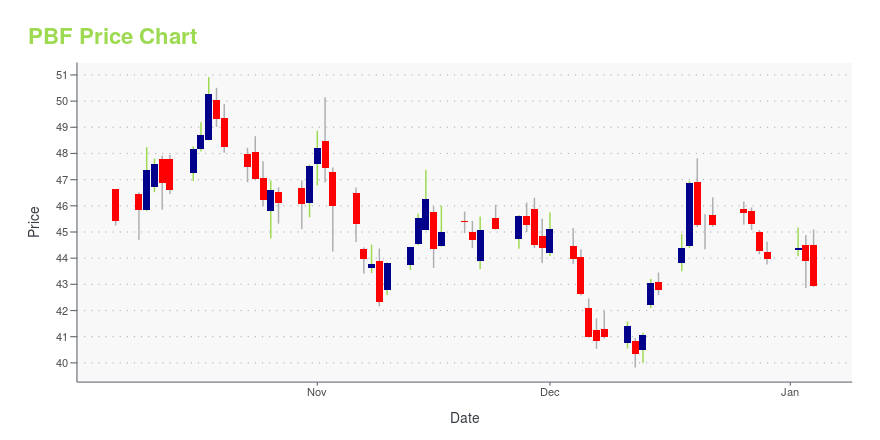

PBF Stock Price Chart Interactive Chart >

PBF Energy Inc. (PBF) Company Bio

PBF Energy engages in the refining and supply of petroleum products. The company was founded in 2008 and is based in Parsippany, New Jersey.

Latest PBF News From Around the Web

Below are the latest news stories about PBF ENERGY INC that investors may wish to consider to help them evaluate PBF as an investment opportunity.

In 2024 The US Will Sell CITGO Petroleum And Pay Out Two Canadian JuniorsVenezuela owns Citgo Petroleum. This is a big company – the 7th largest refiner in North America. By July, a US court may make Venezuela liquidate to pay its debts, and some miners may get unexpected windfalls. |

Are Strong Financial Prospects The Force That Is Driving The Momentum In PBF Energy Inc.'s NYSE:PBF) Stock?PBF Energy's (NYSE:PBF) stock is up by a considerable 14% over the past week. Given that the market rewards strong... |

12 Most Profitable Cheap Stocks To BuyIn this piece, we will take a look at the 12 most profitable cheap stocks to buy. If you want to skip our coverage of the latest happenings in the renewable energy industry, then you can skip ahead to 5 Most Profitable Cheap Stocks To Buy. As investors seek to exit 2023 with the hopes […] |

PBF Energy to Participate in Industry ConferencesPBF Energy Inc. (NYSE:PBF) today announced that members of its management team will participate in the Sankey Research Energy Conference on January 3, 2024, and the Goldman Sachs Energy, CleanTech & Utilities Conference on January 4th and 5th, 2024. |

Discover the cream of the crop mid-cap stocks for serious market outperformanceThe 'Mid-Cap Movers' strategy focuses on a selection of companies that represent the cream of the crop of financial stability. |

PBF Price Returns

| 1-mo | -10.63% |

| 3-mo | -29.61% |

| 6-mo | -15.78% |

| 1-year | -10.26% |

| 3-year | 373.86% |

| 5-year | 52.61% |

| YTD | -7.00% |

| 2023 | 9.97% |

| 2022 | 215.81% |

| 2021 | 82.67% |

| 2020 | -77.12% |

| 2019 | 0.16% |

PBF Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PBF

Want to do more research on PBF Energy Inc's stock and its price? Try the links below:PBF Energy Inc (PBF) Stock Price | Nasdaq

PBF Energy Inc (PBF) Stock Quote, History and News - Yahoo Finance

PBF Energy Inc (PBF) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...