Potbelly Corporation (PBPB): Price and Financial Metrics

PBPB Price/Volume Stats

| Current price | $7.22 | 52-week high | $14.36 |

| Prev. close | $7.26 | 52-week low | $6.77 |

| Day low | $7.17 | Volume | 148,019 |

| Day high | $7.40 | Avg. volume | 258,558 |

| 50-day MA | $7.93 | Dividend yield | N/A |

| 200-day MA | $10.08 | Market Cap | 215.46M |

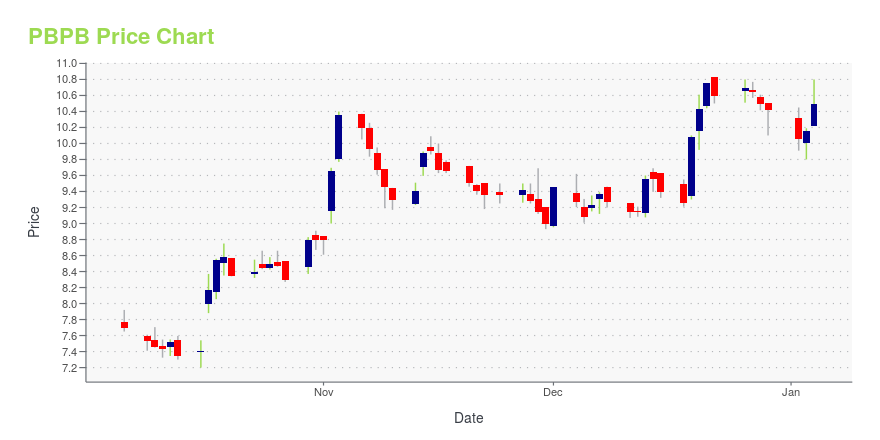

PBPB Stock Price Chart Interactive Chart >

Potbelly Corporation (PBPB) Company Bio

PotBelly Corporation owns and operates Potbelly Sandwich Works sandwich shops in the United States. The company was founded in 1977 and is based in Chicago, Illinois.

Latest PBPB News From Around the Web

Below are the latest news stories about POTBELLY CORP that investors may wish to consider to help them evaluate PBPB as an investment opportunity.

David Nierenberg Increases Stake in Potbelly CorpOn December 20, 2023, David Nierenberg (Trades, Portfolio), through Nierenberg Investment Management Company, made a significant addition to the firm's holdings in Potbelly Corp (NASDAQ:PBPB). The transaction involved the acquisition of 216,005 shares at a trade price of $10.43, increasing the total share count to 2,925,865. Notably, Nierenberg's stake in Potbelly Corp now represents 9.60% of the company's shares. |

Is Potbelly (PBPB) Stock Undervalued Right Now?Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. |

Are Investors Undervaluing Brinker International (EAT) Right Now?Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. |

Will Potbelly Corporation (PBPB) be Able to Improve Earnings by 50% in the Future?Immersion Investment Partners, an investment management company, released its third quarter 2023 investor letter. A copy of the same can be downloaded here. The fund fell 8.62% in the third quarter compared to the 5.12% decline for the Russell 2000 Index. In addition, you can check the top 5 holdings of the fund to know its […] |

Is Potbelly (PBPB) a Great Value Stock Right Now?Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. |

PBPB Price Returns

| 1-mo | -7.20% |

| 3-mo | -32.08% |

| 6-mo | -43.37% |

| 1-year | -24.16% |

| 3-year | 9.23% |

| 5-year | 64.84% |

| YTD | -30.71% |

| 2023 | 87.07% |

| 2022 | -0.18% |

| 2021 | 26.82% |

| 2020 | 4.27% |

| 2019 | -47.58% |

Continue Researching PBPB

Here are a few links from around the web to help you further your research on Potbelly Corp's stock as an investment opportunity:Potbelly Corp (PBPB) Stock Price | Nasdaq

Potbelly Corp (PBPB) Stock Quote, History and News - Yahoo Finance

Potbelly Corp (PBPB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...