PCB Bancorp (PCB): Price and Financial Metrics

PCB Price/Volume Stats

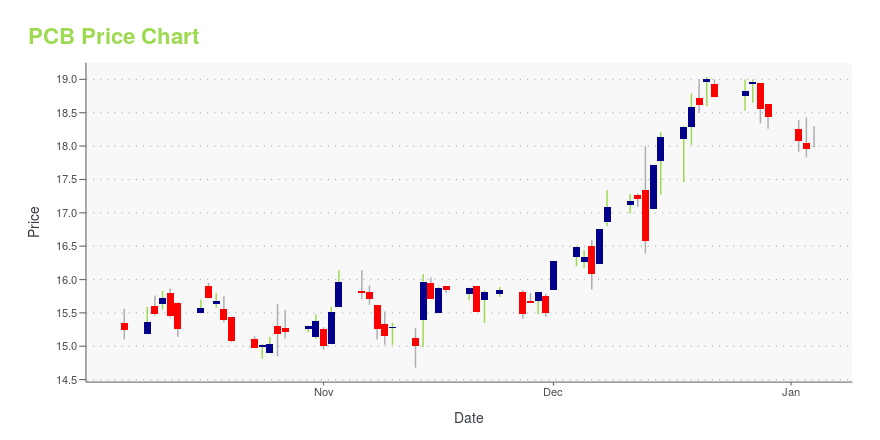

| Current price | $19.80 | 52-week high | $19.82 |

| Prev. close | $19.22 | 52-week low | $14.50 |

| Day low | $19.12 | Volume | 52,868 |

| Day high | $19.82 | Avg. volume | 20,112 |

| 50-day MA | $15.81 | Dividend yield | 3.91% |

| 200-day MA | $16.12 | Market Cap | 282.49M |

PCB Stock Price Chart Interactive Chart >

PCB Bancorp (PCB) Company Bio

Pacific City Financial Corporation operates as a bank holding company for Pacific City Bank that provides various commercial banking products and services to individuals, professionals, and small-to-medium sized businesses in Southern California. The company was founded in 2003 and is based in Los Angeles, California.

Latest PCB News From Around the Web

Below are the latest news stories about PCB BANCORP that investors may wish to consider to help them evaluate PCB as an investment opportunity.

Sang Lee Buys Handful Of Shares In PCB BancorpPotential PCB Bancorp ( NASDAQ:PCB ) shareholders may wish to note that the Independent Chairman of the Board, Sang... |

There's A Lot To Like About PCB Bancorp's (NASDAQ:PCB) Upcoming US$0.18 DividendRegular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see PCB Bancorp... |

PCB Bancorp (NASDAQ:PCB) Just Released Its Third-Quarter Earnings: Here's What Analysts ThinkLast week saw the newest third-quarter earnings release from PCB Bancorp ( NASDAQ:PCB ), an important milestone in the... |

PCB Bancorp Reports Earnings of $7.0 million for Q3 2023LOS ANGELES, October 25, 2023--PCB Bancorp (the "Company") (NASDAQ: PCB), the holding company of PCB Bank (the "Bank"), today reported net income of $7.0 million, or $0.49 per diluted common share, for the third quarter of 2023, compared with $7.5 million, or $0.52 per diluted common share, for the previous quarter and $7.0 million, or $0.46 per diluted common share, for the year-ago quarter. |

PCB Bancorp's (NASDAQ:PCB) largest shareholders are individual investors with 39% ownership, institutions own 35%Key Insights Significant control over PCB Bancorp by individual investors implies that the general public has more... |

PCB Price Returns

| 1-mo | 32.00% |

| 3-mo | 29.49% |

| 6-mo | 13.95% |

| 1-year | 23.00% |

| 3-year | 23.45% |

| 5-year | 38.23% |

| YTD | 9.93% |

| 2023 | 8.85% |

| 2022 | -17.05% |

| 2021 | 122.72% |

| 2020 | -39.25% |

| 2019 | 12.06% |

PCB Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PCB

Want to do more research on Pcb Bancorp's stock and its price? Try the links below:Pcb Bancorp (PCB) Stock Price | Nasdaq

Pcb Bancorp (PCB) Stock Quote, History and News - Yahoo Finance

Pcb Bancorp (PCB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...