PotlatchDeltic Corporation (PCH): Price and Financial Metrics

PCH Price/Volume Stats

| Current price | $43.07 | 52-week high | $53.75 |

| Prev. close | $42.04 | 52-week low | $37.06 |

| Day low | $42.21 | Volume | 537,923 |

| Day high | $43.26 | Avg. volume | 428,086 |

| 50-day MA | $41.09 | Dividend yield | 4.37% |

| 200-day MA | $44.25 | Market Cap | 3.42B |

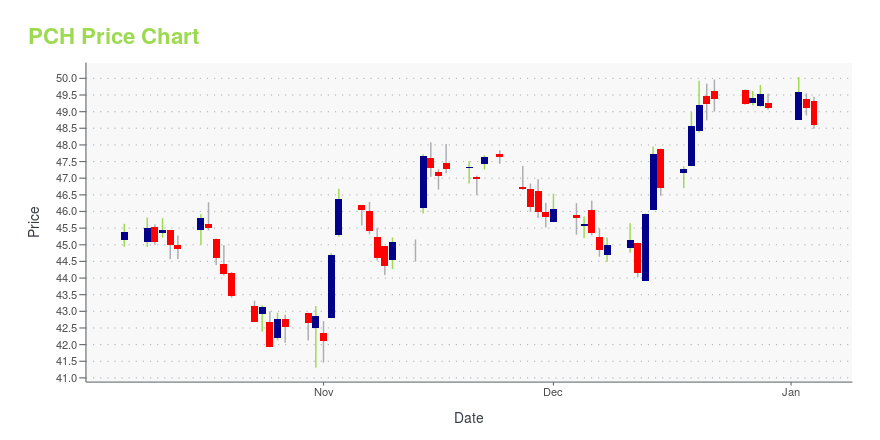

PCH Stock Price Chart Interactive Chart >

PotlatchDeltic Corporation (PCH) Company Bio

PotlatchDeltic (newly named following Potlatch and Deltic Timber merger in February 2018) owns and manages timberlands located in Arkansas, Idaho, Minnesota and Wisconsin in the United States. The Company operates in three business segments: Resource, Wood Products and Real Estate. The company was founded in 1903 and is based in Spokane, Washington.

Latest PCH News From Around the Web

Below are the latest news stories about POTLATCHDELTIC CORP that investors may wish to consider to help them evaluate PCH as an investment opportunity.

5 Market-Beating Construction Picks That Might Lose Steam in 2024Despite reducing inflationary pressure and stable interest rates, a few stocks in the construction sector are likely to perform tepidly in 2024. Let's check what is hurting WY, PCH, CHX, MTZ and HLMN. |

25 Countries With The Highest Deforestation Rates in the WorldIn this article, we shall discuss 25 countries with the highest deforestation rates in the world. To skip our detailed analysis of the global forestry industry and efforts to mitigate the risks posed by global warming, go directly and see 10 Countries With The Highest Deforestation Rates in the World. Governments across the world are […] |

PotlatchDeltic Partners With United Way and Habitat for HumanityNORTHAMPTON, MA / ACCESSWIRE / November 7, 2023 / PotlatchDeltic:PotlatchDeltic has partnered with United Way for over a decade to raise money for local non-profits. At our corporate office in Spokane, Washington, we hold a United Way Week every year. ... |

PotlatchDeltic Corporation (NASDAQ:PCH) Q3 2023 Earnings Call TranscriptPotlatchDeltic Corporation (NASDAQ:PCH) Q3 2023 Earnings Call Transcript October 31, 2023 Operator: Good morning. My name is Sarah, and I will be your conference operator today. At this time, I would like to welcome everyone to the PotlatchDeltic Third Quarter 2023 Conference Call. [Operator Instructions]. I would now like to turn the call over to […] |

Q3 2023 Potlatchdeltic Corp Earnings CallQ3 2023 Potlatchdeltic Corp Earnings Call |

PCH Price Returns

| 1-mo | 10.44% |

| 3-mo | 6.04% |

| 6-mo | -4.40% |

| 1-year | -15.23% |

| 3-year | -0.65% |

| 5-year | 47.50% |

| YTD | -10.48% |

| 2023 | 16.06% |

| 2022 | -22.61% |

| 2021 | 33.11% |

| 2020 | 20.19% |

| 2019 | 42.63% |

PCH Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PCH

Here are a few links from around the web to help you further your research on Potlatchdeltic Corp's stock as an investment opportunity:Potlatchdeltic Corp (PCH) Stock Price | Nasdaq

Potlatchdeltic Corp (PCH) Stock Quote, History and News - Yahoo Finance

Potlatchdeltic Corp (PCH) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...