Pro-Dex, Inc. (PDEX): Price and Financial Metrics

PDEX Price/Volume Stats

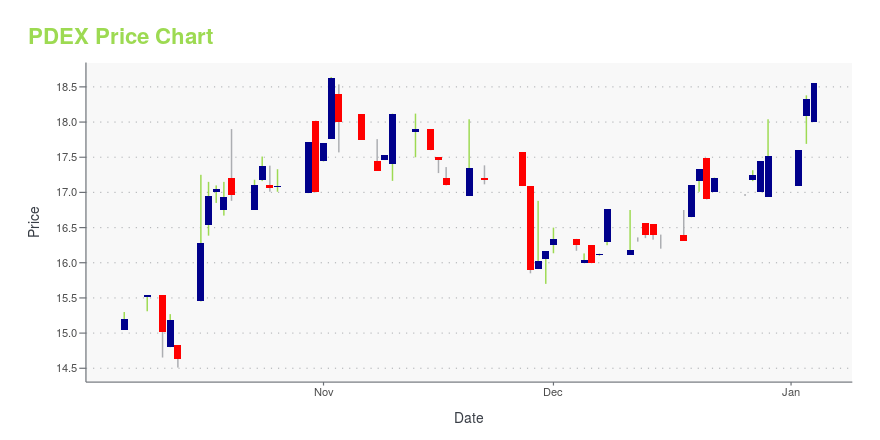

| Current price | $18.79 | 52-week high | $22.99 |

| Prev. close | $19.08 | 52-week low | $14.51 |

| Day low | $18.72 | Volume | 1,813 |

| Day high | $19.43 | Avg. volume | 7,442 |

| 50-day MA | $19.07 | Dividend yield | N/A |

| 200-day MA | $18.25 | Market Cap | 64.24M |

PDEX Stock Price Chart Interactive Chart >

Pro-Dex, Inc. (PDEX) Company Bio

Pro-Dex, Inc. products and distributes medical and dental equipment. The Company offers micro-air motors, surgical drivers, and precision air powered motors. Pro-Dex markets its products in the United States.

Latest PDEX News From Around the Web

Below are the latest news stories about PRO DEX INC that investors may wish to consider to help them evaluate PDEX as an investment opportunity.

3 Very Undervalued Stocks With Strong Growth ProspectsWhile the forward-looking mood for the equities sector may be pivoting in a positive direction, there are still opportunities among undervalued stocks with strong growth potential. |

Here’s Why You Should Consider Buying Pro-Dex (PDEX) SharesLong Cast Advisers, an investment management firm, released its third quarter 2023 investor letter, a copy of which can be downloaded here. In the third quarter of 2023, ending September 30, cumulative net returns stood at 8%. Year-to-date returns up to the quarter’s conclusion reached 20%. Since its inception in November 2015 through the end of […] |

Pro-Dex Inc (PDEX) Reports 8% Increase in Q1 Fiscal 2024 Net Sales, Despite Net Loss of $615,000Operating expenses decrease as gross profit rises by 24% YoY |

Pro-Dex, Inc. Announces Fiscal 2024 First Quarter ResultsIRVINE, CA / ACCESSWIRE / November 2, 2023 / PRO-DEX, INC. (NASDAQ:PDEX) today announced financial results for its fiscal 2024 first quarter ended September 30, 2023. The Company also filed its Quarterly Report on Form 10-Q for the first quarter of ... |

Pro-Dex, Inc. Discusses 4th Quarter and Year-End Results with The Stock Day PodcastPHOENIX, AZ / ACCESSWIRE / October 26, 2023 / The Stock Day Podcast welcomed Pro-Dex, Inc. (NASDAQ:PDEX)("the Company"), a company that specializes in the design, development, and manufacture of autoclavable, battery-powered and electric, multi-function ... |

PDEX Price Returns

| 1-mo | -0.53% |

| 3-mo | 0.59% |

| 6-mo | -12.69% |

| 1-year | N/A |

| 3-year | -36.20% |

| 5-year | 30.31% |

| YTD | 7.25% |

| 2023 | 10.19% |

| 2022 | -31.50% |

| 2021 | -25.06% |

| 2020 | 76.47% |

| 2019 | 45.28% |

Continue Researching PDEX

Want to do more research on Pro Dex Inc's stock and its price? Try the links below:Pro Dex Inc (PDEX) Stock Price | Nasdaq

Pro Dex Inc (PDEX) Stock Quote, History and News - Yahoo Finance

Pro Dex Inc (PDEX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...