Precision Drilling Corporation (PDS): Price and Financial Metrics

PDS Price/Volume Stats

| Current price | $73.07 | 52-week high | $78.13 |

| Prev. close | $72.24 | 52-week low | $49.67 |

| Day low | $71.50 | Volume | 44,113 |

| Day high | $73.48 | Avg. volume | 70,215 |

| 50-day MA | $70.34 | Dividend yield | N/A |

| 200-day MA | $63.80 | Market Cap | 1.05B |

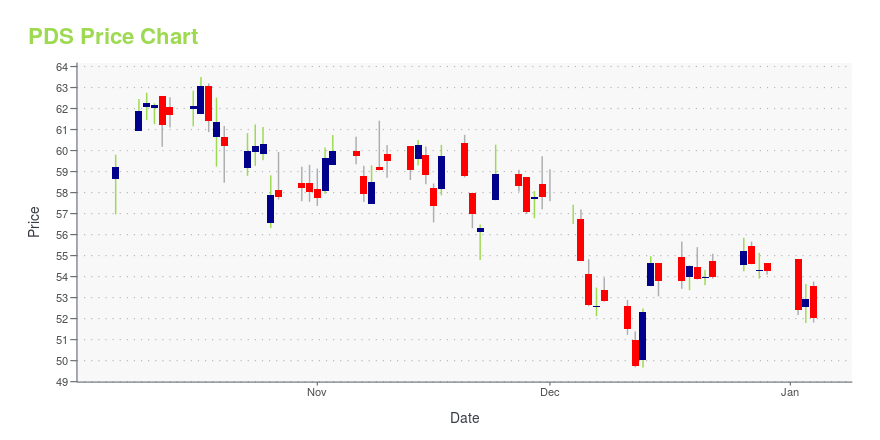

PDS Stock Price Chart Interactive Chart >

Precision Drilling Corporation (PDS) Company Bio

Precision Drilling Corporation provides customers with access to an extensive fleet of contract drilling rigs, directional drilling services, well service and snubbing rigs, coil-tubing services, camps, rental equipment, and water treatment units. The company was founded in 1951 and is based in Calgary, Canada.

Latest PDS News From Around the Web

Below are the latest news stories about PRECISION DRILLING CORP that investors may wish to consider to help them evaluate PDS as an investment opportunity.

13 Most Promising Small-Cap Stocks According to AnalystsIn this piece, we will take a look at the 13 most promising small-cap stocks according to analysts. If you want to skip our overview of small cap investing and the latest stock market news, then you can take a look at the 5 Most Promising Small-Cap Stocks To Buy. Within the broader world of […] |

10 Very Cheap Energy Stocks Ready To ExplodeIn this piece, we will take a look at ten very cheap energy stocks ready to explode. If you want to skip our overview of the energy industry and the latest news, then you can take a look at 5 Very Cheap Energy Stocks Ready To Explode. The global energy industry, despite a growing focus […] |

3 Phenomenal Bargain Energy Stocks That Are No-Brainer Buys Right NowThe energy sector has underperformed this year. Lower commodity prices and rising interest rates have weighed on the sector. Precision Drilling (NYSE: PDS), Brookfield Infrastructure (NYSE: BIP)(NYSE: BIPC), and Enphase (NASDAQ: ENPH) stand out to a few fool.com contributors as top stocks to buy, given how cheap they are these days. |

13 Cheap Energy Stocks To BuyIn this piece, we will take a look at the 13 cheap energy stocks to buy. If you want to skip our overview of the energy industry and some recent trends, then check out 5 Cheap Energy Stocks To Buy. Despite the global push towards renewable energy and emissions free vehicles, the global fossil fuel […] |

Precision Drilling's (TSE:PD) investors will be pleased with their solid 270% return over the last three yearsThe worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put... |

PDS Price Returns

| 1-mo | 5.15% |

| 3-mo | 1.07% |

| 6-mo | 19.12% |

| 1-year | 15.64% |

| 3-year | 117.02% |

| 5-year | 126.93% |

| YTD | 34.59% |

| 2023 | -29.22% |

| 2022 | 116.48% |

| 2021 | 114.86% |

| 2020 | -41.11% |

| 2019 | -19.54% |

Continue Researching PDS

Here are a few links from around the web to help you further your research on PRECISION DRILLING Corp's stock as an investment opportunity:PRECISION DRILLING Corp (PDS) Stock Price | Nasdaq

PRECISION DRILLING Corp (PDS) Stock Quote, History and News - Yahoo Finance

PRECISION DRILLING Corp (PDS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...