PetIQ, Inc. - (PETQ): Price and Financial Metrics

PETQ Price/Volume Stats

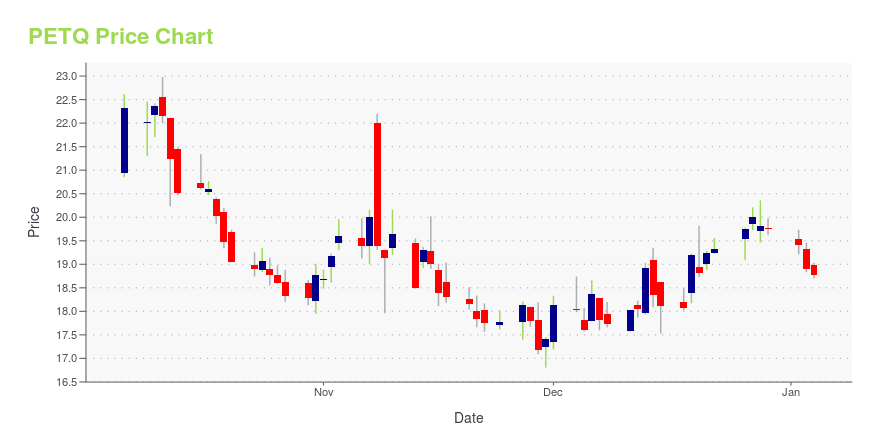

| Current price | $21.89 | 52-week high | $22.98 |

| Prev. close | $21.45 | 52-week low | $15.09 |

| Day low | $21.42 | Volume | 191,000 |

| Day high | $22.15 | Avg. volume | 293,141 |

| 50-day MA | $21.45 | Dividend yield | N/A |

| 200-day MA | $18.97 | Market Cap | 651.27M |

PETQ Stock Price Chart Interactive Chart >

PetIQ, Inc. - (PETQ) Company Bio

PetIQ, Inc. manufactures and distributes health and wellness products for dogs and cats. The Company offers pet prescription medications, over-the-counter flea and tick preventives, health and wellness supplements, and dog and cat treats. The company is based in Eagle, Idaho.

Latest PETQ News From Around the Web

Below are the latest news stories about PETIQ INC that investors may wish to consider to help them evaluate PETQ as an investment opportunity.

Investors in PetIQ (NASDAQ:PETQ) have seen splendid returns of 106% over the past yearWhen you buy shares in a company, there is always a risk that the price drops to zero. But when you pick a company that... |

7 Small-Cap Stocks That Wall Street Loves for Good ReasonThe market rally is showing signs of broadening to include small-cap stocks, here are seven that analysts are upgrading |

7 Small-Cap Stocks That Wall Street Loves for Good ReasonAs we head into 2024, it’s common for investors to look back on 2023. Much of this year had investors in a defensive posture. Small-cap stocks lagged sharply behind the broader market. However, the market rally that started in November is showing signs of broadening to include small-cap stocks. But which ones are ready to shine in 2024? One place for you to start your research is in the stocks that are receiving upgrades from analysts. The market is forward-looking, and analysts are a significan |

PETQ or ABT: Which Is the Better Value Stock Right Now?PETQ vs. ABT: Which Stock Is the Better Value Option? |

Fast-paced Momentum Stock PetIQ (PETQ) Is Still Trading at a BargainPetIQ (PETQ) could be a great choice for investors looking to buy stocks that have gained strong momentum recently but are still trading at reasonable prices. It is one of the several stocks that made it through our 'Fast-Paced Momentum at a Bargain' screen. |

PETQ Price Returns

| 1-mo | 0.41% |

| 3-mo | 32.43% |

| 6-mo | 19.81% |

| 1-year | 35.88% |

| 3-year | -39.21% |

| 5-year | -39.09% |

| YTD | 10.84% |

| 2023 | 114.21% |

| 2022 | -59.40% |

| 2021 | -40.94% |

| 2020 | 53.49% |

| 2019 | 6.73% |

Continue Researching PETQ

Want to see what other sources are saying about PetIQ Inc's financials and stock price? Try the links below:PetIQ Inc (PETQ) Stock Price | Nasdaq

PetIQ Inc (PETQ) Stock Quote, History and News - Yahoo Finance

PetIQ Inc (PETQ) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...