Peoples Financial Corporation (PFBX): Price and Financial Metrics

PFBX Price/Volume Stats

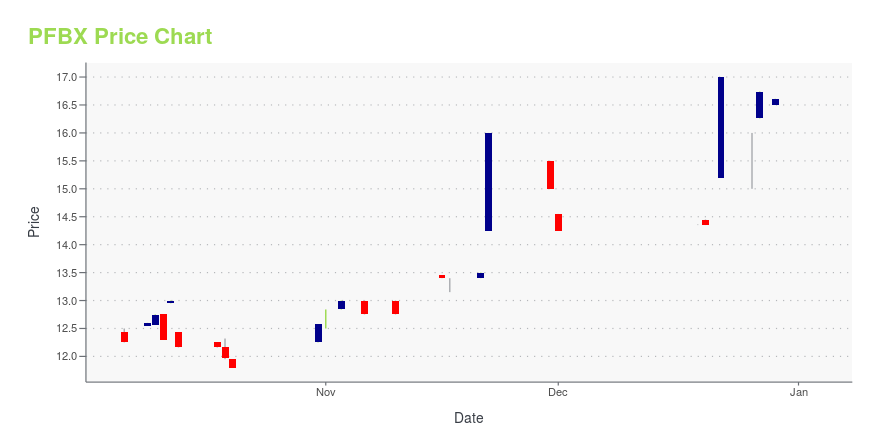

| Current price | $16.50 | 52-week high | $17.50 |

| Prev. close | $16.80 | 52-week low | $11.80 |

| Day low | $16.50 | Volume | 400 |

| Day high | $17.00 | Avg. volume | 1,150 |

| 50-day MA | $15.98 | Dividend yield | 2.14% |

| 200-day MA | $13.94 | Market Cap | 76.92M |

PFBX Stock Price Chart Interactive Chart >

Peoples Financial Corporation (PFBX) Company Bio

Peoples Financial Corporation operates as the bank holding company for The Peoples Bank that provides banking, financial, and trust services to government entities, individuals, and small and commercial businesses in Mississippi. It accepts various deposits, such as interest and non-interest bearing checking accounts, savings accounts, certificates of deposit, and individual retirement accounts (IRAs). The company also offers business, commercial, real estate, construction, personal, and installment loans; and personal trust, agencies, and estate services, including living and testamentary trusts, executorships, guardianships, and conservatorships. In addition, it provides self-directed IRAs; and escrow management, stock transfer, and bond paying agency accounts to corporate customers. Further, the company offers various other services consisting of safe deposit box rental, wire transfer, night drop facilities, collection, cash management, and internet banking services. The company operates through 18 branches located in Harrison, Hancock, Jackson, and Stone counties. It also has 30 automated teller machines at its branch locations, as well as other off-site and non-proprietary locations. The company was founded in 1896 and is headquartered in Biloxi, Mississippi.

Latest PFBX News From Around the Web

Below are the latest news stories about PEOPLES FINANCIAL CORP that investors may wish to consider to help them evaluate PFBX as an investment opportunity.

STILWELL JOSEPH Acquires Additional Shares in Peoples Financial CorpThe shares were acquired at a trade price of $12.99, bringing the firm's total holdings in Peoples Financial Corp to 573,630 shares. STILWELL JOSEPH (Trades, Portfolio) is a firm located at 111 Broadway, 12th Floor, New York, NY 10006. The firm's investment philosophy is centered around identifying undervalued stocks with strong growth potential. |

PEOPLES FINANCIAL CORPORATION REPORTS RESULTS FOR THE THIRD QUARTER OF 2023 AND ANNOUNCES A 50% INCREASE IN REGULAR CASH DIVIDENDS AND THE PAYMENT OF A SPECIAL DIVIDENDPeoples Financial Corporation (the "Company")(OTCQX Best Market: PFBX), parent of The Peoples Bank (the "Bank"), announced earnings for the third quarter ending September 30, 2023. Additionally, the Company declared a regular semi-annual cash dividend of $0.18 per common share, which is a 50% increase over the prior semi-annual dividend paid on May 05, 2023 and a special dividend of $0.23 per common share for a total payment of $1,915,801.26 both payable November 17, 2023 to shareholders of reco |

Two northeastern Pennsylvania banks to mergePeoples Financial Services has agreed to pay $129 million of stock for FNCB Bancorp. Peoples' CEO Craig Best would lead the combined company for a year after the merger closes, and then Gerard Champi, FNCB's current chief, would take over. |

PEOPLES FINANCIAL CORPORATION ANNOUNCES NEW STOCK REPURCHASE PROGRAMThe board of directors of Peoples Financial Corporation (the "Company")(OTCQX Best Market: PFBX), parent of The Peoples Bank (the "Bank"), announced its approval to repurchase up to $1,000,000 in additional shares of the Company's outstanding common stock, effective following the announcement. Shares will be repurchased at the discretion of management either on the open market or through privately negotiated transactions, and repurchased shares will be retired. As of June 30, 2023 the Company re |

PEOPLES FINANCIAL CORPORATION REPORTS RESULTS FOR THE SECOND QUARTER OF 2023, EARNINGS INCREASED $1,818,000 OVER THE SECOND QUARTER OF 2022Peoples Financial Corporation (the "Company")(OTCQX Best Market: PFBX), parent of The Peoples Bank (the "Bank"), announced earnings for the second quarter ending June 30, 2023. |

PFBX Price Returns

| 1-mo | N/A |

| 3-mo | 3.75% |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | N/A |

| 5-year | 56.90% |

| YTD | 0.56% |

| 2023 | N/A |

| 2022 | N/A |

| 2021 | 0.00% |

| 2020 | 23.54% |

| 2019 | -4.53% |

PFBX Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PFBX

Want to do more research on Peoples Financial Corp's stock and its price? Try the links below:Peoples Financial Corp (PFBX) Stock Price | Nasdaq

Peoples Financial Corp (PFBX) Stock Quote, History and News - Yahoo Finance

Peoples Financial Corp (PFBX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...