P & F Industries, Inc. - (PFIN): Price and Financial Metrics

PFIN Price/Volume Stats

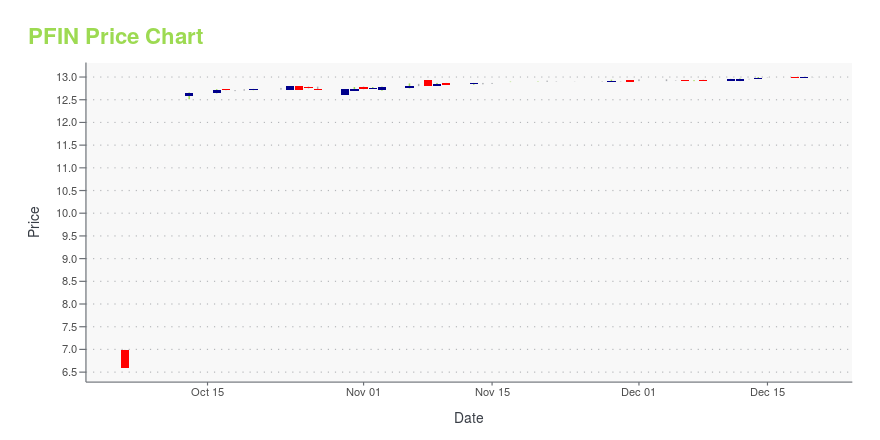

| Current price | $13.00 | 52-week high | $13.00 |

| Prev. close | $12.99 | 52-week low | $4.90 |

| Day low | $13.00 | Volume | 4,000 |

| Day high | $13.00 | Avg. volume | 7,730 |

| 50-day MA | $12.60 | Dividend yield | 1.54% |

| 200-day MA | $7.74 | Market Cap | 41.54M |

PFIN Stock Price Chart Interactive Chart >

P & F Industries, Inc. - (PFIN) Company Bio

P&F Industries, Inc., through its subsidiaries, designs, imports, and sells pneumatic hand tools primarily to the retail, industrial, automotive, and aerospace markets primarily in the United States. The company offers sanders, grinders, drills, saws, and impact wrenches under the Florida Pneumatic, Universal Tool, Jiffy Air Tool, AIRCAT, and NITROCAT names, as well as under private label trade names through in-house sales personnel and manufacturers' representatives to retailers, distributors, manufacturers, and private label customers. It also designs, manufactures, and distributes heavy-duty pneumatic impact tools, grinders, air motors, hydro-pneumatic riveters, hydrostatic test plugs, impact sockets, custom gears, accessories, and various replacement parts under the ATP, Numatx, Thaxton, and Quality Gear brands directly to original equipment manufacturers, as well as through a network of specialized industrial distributors serving power generation, petrochemical, aerospace, construction, railroad, mining, ship building, and fabricated metals industries. P&F Industries, Inc. was incorporated in 1963 and is based in Melville, New York.

Latest PFIN News From Around the Web

Below are the latest news stories about P&F INDUSTRIES INC that investors may wish to consider to help them evaluate PFIN as an investment opportunity.

P&F INDUSTRIES, INC. REPORTS RESULTS FOR THE THREE AND NINE-MONTH PERIODS ENDED SEPTEMBER 30, 2023P&F Industries, Inc. (NASDAQ: PFIN) today announced its results from operations for the three and nine-month periods ended September 30, 2023. The Company is reporting net revenue of $14,404,000 and $46,309,000, respectively, for the three and nine-month periods ended September 30, 2023, compared to $14,516,000 and $46,347,000, respectively, for same periods in 2022. For the three-month period ended September 30, 2023, the Company is reporting a net loss before income taxes of $979,000, compared |

P&F INDUSTRIES TO REPORT RESULTS FOR THE THREE MONTH PERIOD ENDED SEPTEMBER 30, 2023P&F Industries, Inc. (NASDAQ GM: PFIN), plans to release its results for the three-month period ended September 30, 2023, before the market opens on Thursday, November 9, 2023. |

P&F INDUSTRIES, INC. TO BE ACQUIRED BY SHOREVIEW INDUSTRIES FOR $13.00 PER SHAREP&F Industries, Inc. ("P&F" or the "Company") (NASDAQ: PFIN) today announced that it has entered into a definitive agreement to be acquired by ShoreView Industries ("ShoreView") in an all-cash transaction for $13.00 per share. The purchase price represents an approximately 97% premium to the closing stock price of the Company's stock on October 12, 2023, the last trading day prior to announcing the transaction. |

Here's Why We're Wary Of Buying P&F Industries' (NASDAQ:PFIN) For Its Upcoming DividendIt looks like P&F Industries, Inc. ( NASDAQ:PFIN ) is about to go ex-dividend in the next 4 days. The ex-dividend date... |

Some Investors May Be Worried About P&F Industries' (NASDAQ:PFIN) Returns On CapitalWhen it comes to investing, there are some useful financial metrics that can warn us when a business is potentially in... |

PFIN Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 77.93% |

| 3-year | 97.68% |

| 5-year | N/A |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -17.21% |

| 2021 | 0.83% |

| 2020 | -14.02% |

| 2019 | -5.81% |

PFIN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PFIN

Here are a few links from around the web to help you further your research on P&F Industries Inc's stock as an investment opportunity:P&F Industries Inc (PFIN) Stock Price | Nasdaq

P&F Industries Inc (PFIN) Stock Quote, History and News - Yahoo Finance

P&F Industries Inc (PFIN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...