Phunware Inc. (PHUN): Price and Financial Metrics

PHUN Price/Volume Stats

| Current price | $4.88 | 52-week high | $24.49 |

| Prev. close | $4.63 | 52-week low | $3.50 |

| Day low | $4.61 | Volume | 293,111 |

| Day high | $4.89 | Avg. volume | 2,242,031 |

| 50-day MA | $5.83 | Dividend yield | N/A |

| 200-day MA | $8.08 | Market Cap | 40.37M |

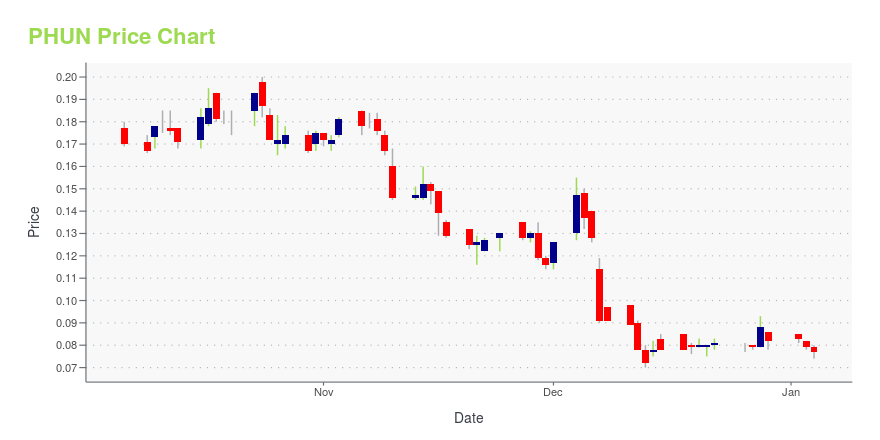

PHUN Stock Price Chart Interactive Chart >

Phunware Inc. (PHUN) Company Bio

Phunware Inc. is the pioneer of Multiscreen-as-a-Service (MaaS), a fully integrated enterprise cloud platform for mobile that provides companies the products, solutions, data, and services necessary to engage, manage, and monetize their mobile application portfolios and audiences globally at scale.

Latest PHUN News From Around the Web

Below are the latest news stories about PHUNWARE INC that investors may wish to consider to help them evaluate PHUN as an investment opportunity.

Phunware Announces Closing of $2.8 Million Public OfferingAUSTIN, Texas, Dec. 11, 2023 (GLOBE NEWSWIRE) -- Phunware, Inc. (Nasdaq: PHUN, “Phunware”), the pioneer of patented Location Based SaaS solutions and other products that offer the only fully integrated enterprise cloud platform for mobile that enables brands to engage, manage and monetize anyone anywhere, today announced that it closed its previously announced public offering of approximately 46.7 million shares of common stock (or pre-funded warrants in lieu thereof) at a price of $0.06 per sha |

Phunware Announces Pricing of $2.8 Million Public OfferingAUSTIN, Texas, December 07, 2023--Phunware Announces Pricing of $2.8 Million Public Offering |

Phunware Launches Proposed Public Offering of SecuritiesAUSTIN, Texas, Dec. 06, 2023 (GLOBE NEWSWIRE) -- Phunware, Inc. (Nasdaq: PHUN, “Phunware”), the pioneer of patented Location Based SaaS solutions and other products that offer the only fully integrated enterprise cloud platform for mobile that enables brands to engage, manage and monetize anyone anywhere, today announced that it has launched a public offering to offer and sell shares of its common stock (or pre-funded warrants in lieu thereof). All of the shares of common stock (and pre-funded w |

11 Most Volatile Stocks Under $5 For Day TradingIn this piece, we will take a look at the 11 most volatile stocks under $5 for day trading. If you want to skip our introduction to stock indicators and the broader market environment, then take a look at 5 Most Volatile Stocks Under $5 For Day Trading. While all stocks can be bought on […] |

Phunware Appoints Jeremy Kidd as Senior Vice President of Sales and MarketingAUSTIN, Texas, Nov. 29, 2023 (GLOBE NEWSWIRE) -- Phunware, Inc. (NASDAQ: PHUN) (the “Company”), the pioneer of patented Location Based SaaS solutions that offer the only fully integrated enterprise cloud platform for mobile that enables brands to engage, manage and monetize anyone anywhere, announced today that Jeremy Kidd has been hired as its Senior Vice President of Sales and Marketing, effective November 22, 2023. Jeremy comes to Phunware with over two decades of sales leadership in mobile a |

PHUN Price Returns

| 1-mo | -20.52% |

| 3-mo | -23.51% |

| 6-mo | -69.30% |

| 1-year | -73.18% |

| 3-year | -90.52% |

| 5-year | -94.39% |

| YTD | 19.02% |

| 2023 | -89.40% |

| 2022 | -70.60% |

| 2021 | 108.73% |

| 2020 | 5.88% |

| 2019 | -91.65% |

Continue Researching PHUN

Want to do more research on Phunware Inc's stock and its price? Try the links below:Phunware Inc (PHUN) Stock Price | Nasdaq

Phunware Inc (PHUN) Stock Quote, History and News - Yahoo Finance

Phunware Inc (PHUN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...