ShiftPixy, Inc. (PIXY): Price and Financial Metrics

PIXY Price/Volume Stats

| Current price | $1.61 | 52-week high | $49.44 |

| Prev. close | $1.56 | 52-week low | $1.38 |

| Day low | $1.51 | Volume | 97,915 |

| Day high | $1.70 | Avg. volume | 534,829 |

| 50-day MA | $1.72 | Dividend yield | N/A |

| 200-day MA | $4.53 | Market Cap | 10.88M |

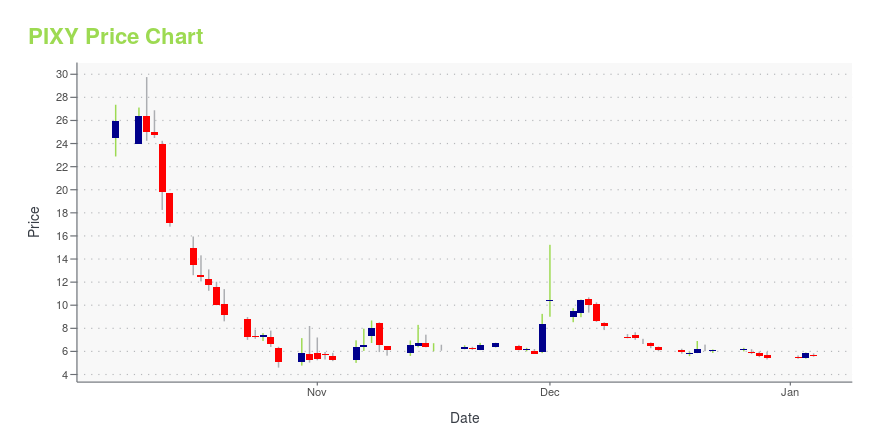

PIXY Stock Price Chart Interactive Chart >

ShiftPixy, Inc. (PIXY) Company Bio

ShiftPixy, Inc. designs and develops application software. The Company provides a scheduling and recruiting application platform which enables users to sync work opportunities, manage relationships with job providers, and update profiles of shift workers. ShiftPixy serves customers in the United States.

Latest PIXY News From Around the Web

Below are the latest news stories about SHIFTPIXY INC that investors may wish to consider to help them evaluate PIXY as an investment opportunity.

PIXY Stock Earnings: ShiftPixy Beats EPS, Misses Revenue for Q4 2023PIXY stock results show that ShiftPixy beat analyst estimates for earnings per share but missed on revenue for the fourth quarter of 2023. |

Dow, SPX Heading For 5th-Straight Weekly WinWall Street is mostly higher this afternoon. |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on FridayIt's the final day of trading this week and we're starting it with a breakdown of the biggest pre-market stock movers on Friday morning! |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on WednesdayPre-market stock movers are a hot topic worth checking out on Wednesday and we have all the latest news happening this morning! |

ShiftPixy Discusses Revolutionary Employment Platform for The Rapidly Growing Gig Economy with The Stock Day PodcastPHOENIX, AZ / ACCESSWIRE / October 9, 2023 / The Stock Day Podcast welcomed ShiftPixy, Inc. (Nasdaq:PIXY) ("ShiftPixy" or the "Company"), a Florida-based national staffing enterprise which designs, manages, and sells access to a disruptive, revolutionary ... |

PIXY Price Returns

| 1-mo | -9.04% |

| 3-mo | -14.36% |

| 6-mo | -70.67% |

| 1-year | -93.79% |

| 3-year | -99.96% |

| 5-year | -100.00% |

| YTD | -70.51% |

| 2023 | -98.91% |

| 2022 | -82.09% |

| 2021 | -53.01% |

| 2020 | -71.18% |

| 2019 | -87.80% |

Continue Researching PIXY

Here are a few links from around the web to help you further your research on ShiftPixy Inc's stock as an investment opportunity:ShiftPixy Inc (PIXY) Stock Price | Nasdaq

ShiftPixy Inc (PIXY) Stock Quote, History and News - Yahoo Finance

ShiftPixy Inc (PIXY) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...