Park Hotels & Resorts Inc. (PK): Price and Financial Metrics

PK Price/Volume Stats

| Current price | $9.72 | 52-week high | $17.86 |

| Prev. close | $10.87 | 52-week low | $9.60 |

| Day low | $9.60 | Volume | 7,997,000 |

| Day high | $10.43 | Avg. volume | 3,855,481 |

| 50-day MA | $12.24 | Dividend yield | 9.3% |

| 200-day MA | $13.98 | Market Cap | 1.96B |

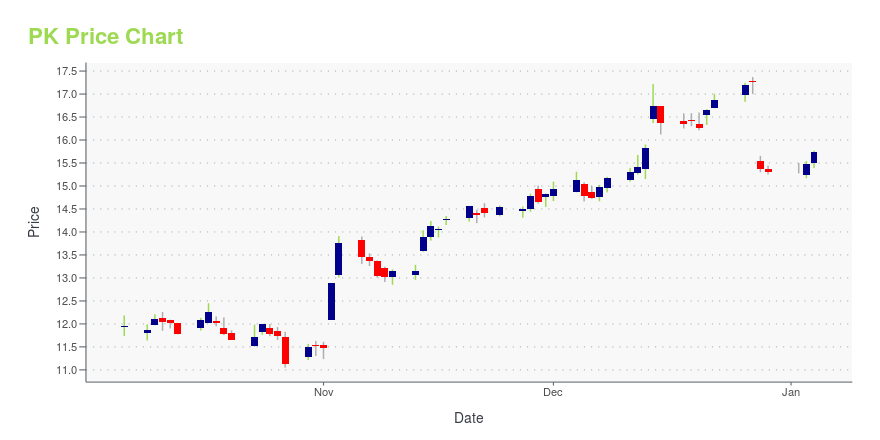

PK Stock Price Chart Interactive Chart >

Park Hotels & Resorts Inc. (PK) Company Bio

Park Hotels & Resorts Inc. was established as an independent company on January 3, 2017, following its spin-off from Hilton Worldwide Holdings, Inc. The company is a lodging real estate company with its portfolio consists of approximately 67 premium-branded hotels and resorts with over 35,000 rooms located in prime United States and internationally. Over 85% of Park’s portfolio is in the luxury or upper upscale segment and 100% is in the U.S., including locations in 14 of the top 25 markets. Nearly 80% of the company’s portfolio is in the central business districts of major cities or resort or conference destinations. Thomas J. Baltimore, Jr. serves as Park’s President and Chief Executive Officer and the company has approximately 500 employees.

PK Price Returns

| 1-mo | -16.47% |

| 3-mo | -29.89% |

| 6-mo | -27.92% |

| 1-year | -37.10% |

| 3-year | -31.45% |

| 5-year | 113.35% |

| YTD | -29.30% |

| 2024 | 0.98% |

| 2023 | 49.45% |

| 2022 | -36.03% |

| 2021 | 10.09% |

| 2020 | -30.13% |

PK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PK

Want to do more research on Park Hotels & Resorts Inc's stock and its price? Try the links below:Park Hotels & Resorts Inc (PK) Stock Price | Nasdaq

Park Hotels & Resorts Inc (PK) Stock Quote, History and News - Yahoo Finance

Park Hotels & Resorts Inc (PK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...