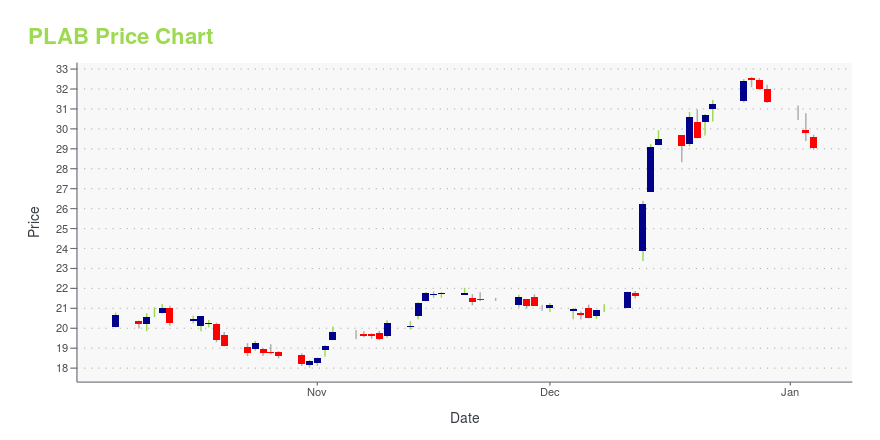

Photronics, Inc. (PLAB): Price and Financial Metrics

PLAB Price/Volume Stats

| Current price | $25.62 | 52-week high | $34.16 |

| Prev. close | $25.22 | 52-week low | $18.03 |

| Day low | $24.88 | Volume | 650,400 |

| Day high | $26.23 | Avg. volume | 518,409 |

| 50-day MA | $26.16 | Dividend yield | N/A |

| 200-day MA | $26.49 | Market Cap | 1.62B |

PLAB Stock Price Chart Interactive Chart >

Photronics, Inc. (PLAB) Company Bio

Photronics Inc. offers services across the full spectrum of integrated chip production and flat panel display technologies by manufacturing photomasks using electron beam or optical (laser-based) systems. The company was founded in 1969 and is based in Brookfield, Connecticut.

Latest PLAB News From Around the Web

Below are the latest news stories about PHOTRONICS INC that investors may wish to consider to help them evaluate PLAB as an investment opportunity.

The Next Big Thing: 3 Tech Stocks Ready for a 500% Leap by 2027Are you looking for the next big thing in the stock-market? |

Photronics (PLAB) Increases Yet Falls Behind Market: What Investors Need to KnowPhotronics (PLAB) reachead $32.43 at the closing of the latest trading day, reflecting a +0.12% change compared to its last close. |

5 Low-Leverage Stocks to Buy on Rate Cut ExpectationsThe crux of safe investment lies in choosing a company that is not burdened with debt. This is because a debt-free stock is almost impossible to find. You can consider stocks like VIRC, PLAB, ALE, TNK and ATO. |

4 High Earnings Yield Value Stocks To Buy Heading Into 2024The last 12 months might have been a rollercoaster ride for investors but they have ultimately turned out to be rewarding. |

Zacks.com featured highlights include EMCOR Group, Arcos Dorados, Photronics and CiveoEMCOR Group, Arcos Dorados, Photronics and Civeo are part of the Zacks Screen of the Week article. |

PLAB Price Returns

| 1-mo | 3.81% |

| 3-mo | -9.41% |

| 6-mo | -15.00% |

| 1-year | 0.75% |

| 3-year | 94.68% |

| 5-year | 162.23% |

| YTD | -18.33% |

| 2023 | 86.39% |

| 2022 | -10.72% |

| 2021 | 68.91% |

| 2020 | -29.19% |

| 2019 | 62.81% |

Continue Researching PLAB

Want to see what other sources are saying about Photronics Inc's financials and stock price? Try the links below:Photronics Inc (PLAB) Stock Price | Nasdaq

Photronics Inc (PLAB) Stock Quote, History and News - Yahoo Finance

Photronics Inc (PLAB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...