Planet Green Holdings Corp (PLAG): Price and Financial Metrics

PLAG Price/Volume Stats

| Current price | $1.87 | 52-week high | $9.30 |

| Prev. close | $1.86 | 52-week low | $1.32 |

| Day low | $1.87 | Volume | 9,785 |

| Day high | $2.01 | Avg. volume | 9,352 |

| 50-day MA | $1.90 | Dividend yield | N/A |

| 200-day MA | $3.40 | Market Cap | 13.48M |

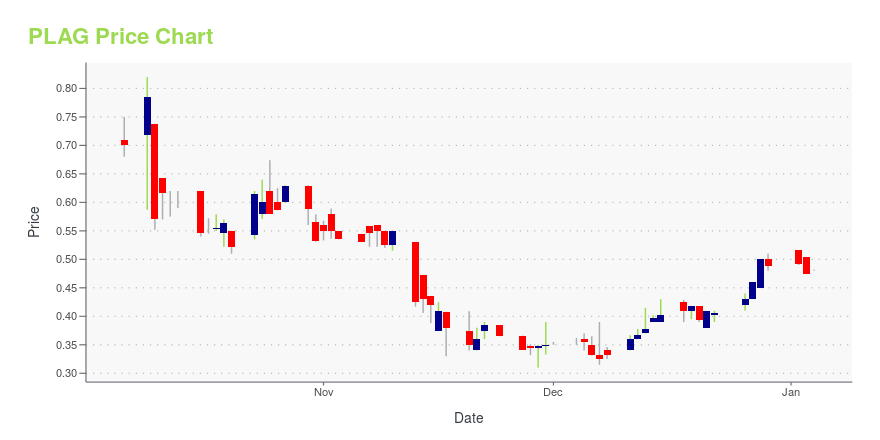

PLAG Stock Price Chart Interactive Chart >

Planet Green Holdings Corp (PLAG) Company Bio

Planet Green Holdings Corp engages in the development, manufacture, and sale of processed food products. The Company offers chestnut products and convenience foods. Planet Green Holdings serves customers worldwide.

Latest PLAG News From Around the Web

Below are the latest news stories about PLANET GREEN HOLDINGS CORP that investors may wish to consider to help them evaluate PLAG as an investment opportunity.

Planet Green Holdings Corp Subsidiary Allinyson Ltd Forges Strategic Partnership with MetaMind AI Limited on AI Technology SolutionsPlanet Green Holdings Corp. ("Planet Green", the "Company") (NYSE American: PLAG) a provider of consumer products, chemical products, and online advertising and mobile games on the Chinese and North American markets, announced today that its subsidiary Allinyson Ltd. ("Allinyson") has achieved an one-year-term groundbreaking strategic partnership with MetaMind AI Limited ("MetaMind"), aiming to revolutionize the landscape of artificial intelligence (AI) technology services. This collaboration, e |

Subsidiary of Planet Green Holdings Corp. Announces Launch of Integrated AI Intelligent Conversational Robot Product ChatAlpha, Revolutionizing AI Conversations with Advanced Natural Language Processing and GPT-4 IntegrationPlanet Green Holdings Corp. ("Planet Green", the "Company") (NYSE American: PLAG) a provider of consumer products, chemical products, and online advertising and mobile games on the Chinese and North American markets, announced today that its subsidiary Allinyson Ltd. ("Allinyson") has unveiled its latest breakthrough product, ChatAlpha - the next generation integrated AI conversational robot. This cutting-edge creation is set to transform the way users engage with AI-powered assistants. |

Subsidiary of Planet Green Holdings Corp. Announces Launch of Mind-Engaging Mobile Game Powered by Cutting-Edge AI TechnologiesPlanet Green Holdings Corp. ("Planet Green", the "Company") (NYSE American: PLAG) a provider of consumer products, chemical products, and online advertising and mobile games on the Chinese and North American markets, announced that its subsidiary Allinyson Ltd. ("Allinyson") has successfully launched Solitaire King, a mind-engaging mobile game powered by cutting-edge AI technologies. The newly launched game is a card game that helps relax and train your brains with fun animations and a choice to |

PLAG Price Returns

| 1-mo | 24.67% |

| 3-mo | -13.02% |

| 6-mo | -54.72% |

| 1-year | -64.55% |

| 3-year | -85.94% |

| 5-year | -95.57% |

| YTD | -61.77% |

| 2023 | -21.11% |

| 2022 | -39.22% |

| 2021 | -54.26% |

| 2020 | -18.61% |

| 2019 | 11.84% |

Continue Researching PLAG

Here are a few links from around the web to help you further your research on Planet Green Holdings Corp's stock as an investment opportunity:Planet Green Holdings Corp (PLAG) Stock Price | Nasdaq

Planet Green Holdings Corp (PLAG) Stock Quote, History and News - Yahoo Finance

Planet Green Holdings Corp (PLAG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...