Prologis Inc. (PLD): Price and Financial Metrics

PLD Price/Volume Stats

| Current price | $100.11 | 52-week high | $132.57 |

| Prev. close | $98.63 | 52-week low | $85.35 |

| Day low | $99.46 | Volume | 143,903 |

| Day high | $100.62 | Avg. volume | 4,779,949 |

| 50-day MA | $112.02 | Dividend yield | 4.03% |

| 200-day MA | $116.97 | Market Cap | 92.80B |

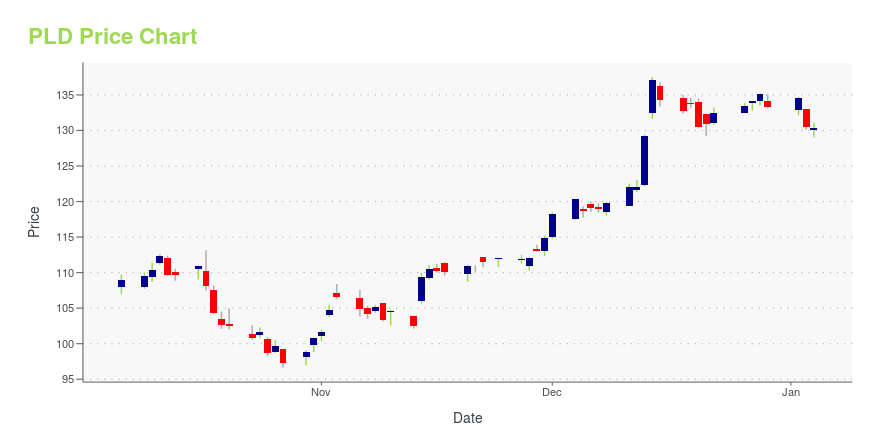

PLD Stock Price Chart Interactive Chart >

Prologis Inc. (PLD) Company Bio

Prologis, Inc. is a real estate investment trust headquartered in San Francisco, California that invests in logistics facilities, with a focus on the consumption side of the global supply chain. The company was formed through the merger of AMB Property Corporation and ProLogis in June 2011, which made Prologis the largest industrial real estate company in the world. As of December 31, 2020, the company owned 4,703 buildings comprising 984 million square feet in 19 countries in North America, Latin America, Europe, and Asia. According to The Economist, its business strategy is focused on warehouses that are located close to huge urban areas where land is scarce. It serves over 5,000 tenants. Prologis created a venture capital arm in 2016. (Source:Wikipedia)

PLD Price Returns

| 1-mo | -7.66% |

| 3-mo | -12.27% |

| 6-mo | -15.37% |

| 1-year | -0.53% |

| 3-year | -35.15% |

| 5-year | 31.63% |

| YTD | -4.45% |

| 2024 | -18.12% |

| 2023 | 21.58% |

| 2022 | -31.33% |

| 2021 | 72.33% |

| 2020 | 14.74% |

PLD Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PLD

Want to do more research on Prologis Inc's stock and its price? Try the links below:Prologis Inc (PLD) Stock Price | Nasdaq

Prologis Inc (PLD) Stock Quote, History and News - Yahoo Finance

Prologis Inc (PLD) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...