Pulse Biosciences, Inc (PLSE): Price and Financial Metrics

PLSE Price/Volume Stats

| Current price | $15.10 | 52-week high | $25.00 |

| Prev. close | $15.65 | 52-week low | $13.50 |

| Day low | $15.07 | Volume | 210,200 |

| Day high | $15.84 | Avg. volume | 176,059 |

| 50-day MA | $16.28 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 1.02B |

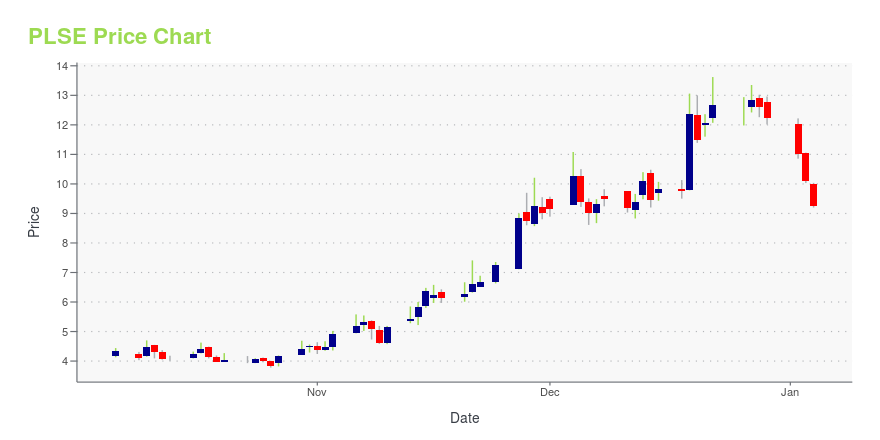

PLSE Stock Price Chart Interactive Chart >

Pulse Biosciences, Inc (PLSE) Company Bio

Pulse Biosciences, a development stage medical device company, focuses on developing medical technologies based on sub-microsecond pulsed electric field technology to detect and treat skin cancer and enhance wound healing. The company was founded in 2014 and is based in Burlingame, California.

PLSE Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -5.39% |

| 3-year | 658.79% |

| 5-year | 29.06% |

| YTD | -13.27% |

| 2024 | 42.24% |

| 2023 | 341.88% |

| 2022 | -81.30% |

| 2021 | -37.93% |

| 2020 | 77.93% |

Loading social stream, please wait...