Plug Power, Inc. (PLUG): Price and Financial Metrics

PLUG Price/Volume Stats

| Current price | $2.49 | 52-week high | $13.17 |

| Prev. close | $2.33 | 52-week low | $2.21 |

| Day low | $2.37 | Volume | 45,257,400 |

| Day high | $2.53 | Avg. volume | 39,945,699 |

| 50-day MA | $2.85 | Dividend yield | N/A |

| 200-day MA | $3.74 | Market Cap | 1.85B |

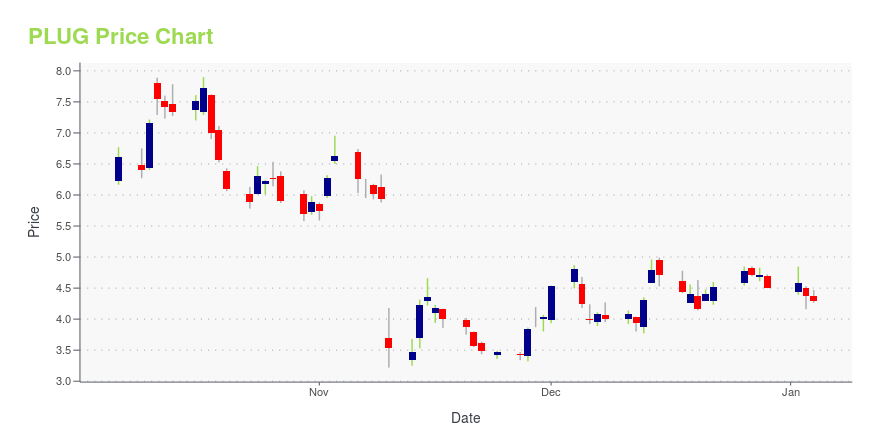

PLUG Stock Price Chart Interactive Chart >

Plug Power, Inc. (PLUG) Company Bio

Plug Power Inc provides alternative energy technology. It is engaged in the design, development, commercialization, and manufacture of hydrogen fuel cell systems used for the industrial off-road market and the stationary power market. Some of the company’s more recognizable customers include Amazon, BMW, The Southern Company, Carrefour, and WalMart. Plug Power has recently expanded its offerings to serve the zero-emission vehicle, robotics, and data center markets. The company is headquartered in Latham, New York and has offices in Washington D.C. and the Netherlands. Plug Power expanded it’s workforce in the last year for a current total of over 800 employees. The company’s Chief Executive Officer is Andrew J. Marsh.

Latest PLUG News From Around the Web

Below are the latest news stories about PLUG POWER INC that investors may wish to consider to help them evaluate PLUG as an investment opportunity.

EV Game Changers: 7 Stocks Fueling the Green Energy MovementUnlock value in the EV sector by wagering on these top EV stocks blending financial resilience with innovation in a rapidly evolving market. |

Plug Power (PLUG) Installs Electrolyzer at Amazon FacilityPlug Power (PLUG) installed electrolyzer, which is capable of powering more than 225 hydrogen fuel cell-powered DEN8 forklift trucks at Aurora-based Amazon fulfillment center. |

After Crashing 63% in 2023, Is Plug Power a No-Brainer Buy for 2024?Can this fuel cell and hydrogen stock provide power-packed returns in the new year? |

11 Most Promising Hydrogen and Fuel Cell Stocks According to AnalystsIn this piece, we will take a look at the 11 most promising hydrogen and fuel cell stocks according to analysts. If you want to skip our overview of this particular sub segment of the clean energy industry, then you can take a look at the 5 Most Promising Hydrogen and Fuel Cell Stocks to […] |

Green Hydrogen Fans See Red Over Tax-Credit ProposalCredits of up to $3 a kilogram were expected to draw investment in plants that make hydrogen, but the eligibility rules are strict. |

PLUG Price Returns

| 1-mo | 1.63% |

| 3-mo | 3.32% |

| 6-mo | -26.76% |

| 1-year | -78.63% |

| 3-year | -90.62% |

| 5-year | 10.67% |

| YTD | -44.67% |

| 2023 | -63.62% |

| 2022 | -56.18% |

| 2021 | -16.75% |

| 2020 | 973.10% |

| 2019 | 154.84% |

Continue Researching PLUG

Want to do more research on Plug Power Inc's stock and its price? Try the links below:Plug Power Inc (PLUG) Stock Price | Nasdaq

Plug Power Inc (PLUG) Stock Quote, History and News - Yahoo Finance

Plug Power Inc (PLUG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...