ePlus inc. (PLUS): Price and Financial Metrics

PLUS Price/Volume Stats

| Current price | $91.02 | 52-week high | $91.41 |

| Prev. close | $87.95 | 52-week low | $53.53 |

| Day low | $87.89 | Volume | 240,383 |

| Day high | $91.41 | Avg. volume | 203,506 |

| 50-day MA | $76.82 | Dividend yield | N/A |

| 200-day MA | $74.50 | Market Cap | 2.45B |

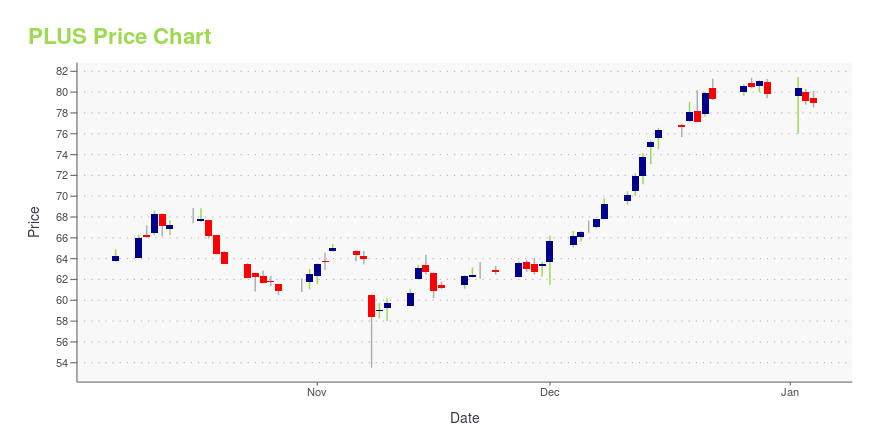

PLUS Stock Price Chart Interactive Chart >

ePlus inc. (PLUS) Company Bio

ePlus Inc. designs, implements and provides provide leading information technology products and services, flexible leasing and financing solutions, and enterprise supply management to enable its customers to optimize their IT infrastructure and supply chain processes. The company was founded in 1990 and is based in Herndon, Virginia.

Latest PLUS News From Around the Web

Below are the latest news stories about EPLUS INC that investors may wish to consider to help them evaluate PLUS as an investment opportunity.

ePlus' (NASDAQ:PLUS) five-year earnings growth trails the 18% YoY shareholder returnsThe most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company... |

ePlus Achieves the AWS Resilience CompetencyePlus inc. (NASDAQ NGS: PLUS – news) today announced that it has achieved the Amazon Web Services (AWS) Resilience Competency in the Resilience Recovery category. This specialization recognizes ePlus as an AWS Partner using AWS Resilience Services to provide validated solutions to help customers improve their critical systems availability and resilience posture. As each customer and their critical workloads have unique availability requirements, AWS Resilience Competency Partners provide tailore |

Estimating The Intrinsic Value Of ePlus inc. (NASDAQ:PLUS)Key Insights Using the 2 Stage Free Cash Flow to Equity, ePlus fair value estimate is US$59.80 Current share price of... |

Cisco Awards ePlus the Global Customer Experience (CX) Partner of the Year at Cisco Partner SummitePlus inc. (NASDAQ NGS: PLUS – news) today announced it has been named the Global Customer Experience (CX) Partner of the Year at Cisco Partner Summit 2023. Cisco's Partner Summit Global Awards recognize top-performing partners across 21 categories demonstrating innovation in delivering solutions that help customers succeed in new ways. |

ePlus inc. (NASDAQ:PLUS) Q2 2024 Earnings Call TranscriptePlus inc. (NASDAQ:PLUS) Q2 2024 Earnings Call Transcript November 7, 2023 ePlus inc. misses on earnings expectations. Reported EPS is $1.22 EPS, expectations were $1.34. Operator: Good day, ladies and gentlemen. Welcome to the ePlus Earnings Results Conference Call. As a reminder, this conference call is being recorded. I would now like to introduce your […] |

PLUS Price Returns

| 1-mo | 26.57% |

| 3-mo | 16.41% |

| 6-mo | 19.75% |

| 1-year | 57.39% |

| 3-year | 101.91% |

| 5-year | 140.83% |

| YTD | 14.00% |

| 2023 | 80.31% |

| 2022 | -17.82% |

| 2021 | 22.52% |

| 2020 | 4.34% |

| 2019 | 18.43% |

Continue Researching PLUS

Want to see what other sources are saying about Eplus Inc's financials and stock price? Try the links below:Eplus Inc (PLUS) Stock Price | Nasdaq

Eplus Inc (PLUS) Stock Quote, History and News - Yahoo Finance

Eplus Inc (PLUS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...