PrimeEnergy Resources Corporation (PNRG): Price and Financial Metrics

PNRG Price/Volume Stats

| Current price | $117.26 | 52-week high | $120.93 |

| Prev. close | $117.99 | 52-week low | $92.01 |

| Day low | $117.26 | Volume | 547 |

| Day high | $117.26 | Avg. volume | 2,220 |

| 50-day MA | $110.24 | Dividend yield | N/A |

| 200-day MA | $104.49 | Market Cap | 209.31M |

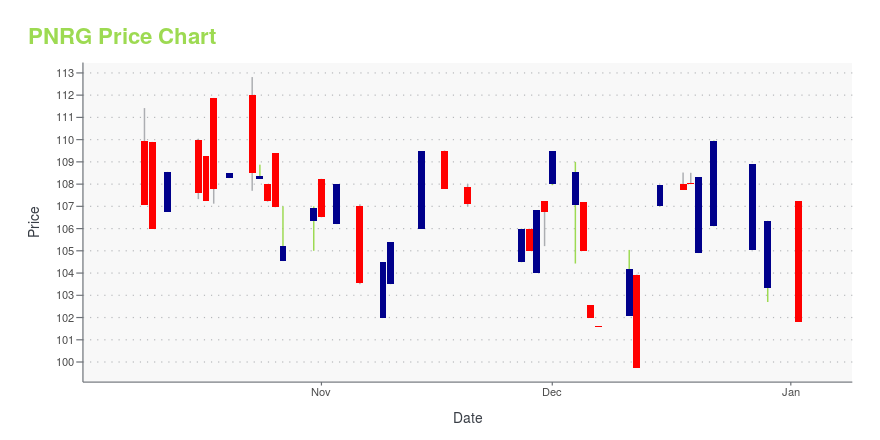

PNRG Stock Price Chart Interactive Chart >

PrimeEnergy Resources Corporation (PNRG) Company Bio

PrimeEnergy Corporation, an independent oil and natural gas company, through its subsidiaries, engages in the acquisition, development, and production of oil and natural gas properties in the United States. The company was founded in 1973 and is based in Houston, Texas.

Latest PNRG News From Around the Web

Below are the latest news stories about PRIMEENERGY RESOURCES CORP that investors may wish to consider to help them evaluate PNRG as an investment opportunity.

PrimeEnergy Resources Corporation Announces Third Quarter Unaudited ResultsHOUSTON, November 17, 2023--PrimeEnergy Resources Corporation (NASDAQ: PNRG) announces third quarter unaudited results for the periods ended September 30, 2023 and 2022. |

Here's Why PrimeEnergy Resources (NASDAQ:PNRG) Has Caught The Eye Of InvestorsInvestors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks... |

PrimeEnergy Resources Corporation's (NASDAQ:PNRG) Stock's On An Uptrend: Are Strong Financials Guiding The Market?PrimeEnergy Resources' (NASDAQ:PNRG) stock is up by a considerable 10% over the past three months. Given that the... |

CORRECTING and REPLACING PrimeEnergy Resources Corporation Announces Second Quarter ResultsHOUSTON, August 15, 2023--In column "2022" of table "Six Months Ended June 30" of release dated August, 14, 2023, the figure for "Barrels of Oil Produced" should read 508,000 (instead of 165,000) and the figure for "Average Price Received" should read $102.64 (instead of $104). |

PrimeEnergy Resources Corporation joins the Russell 2000® IndexHOUSTON, June 30, 2023--PrimeEnergy Resources Corporation (NASDAQ: PNRG) ("PrimeEnergy" or "Company") announced today that the Company was added to the broad-market Russell 2000 Index at the conclusion of the 2023 Russell Indexes annual reconstitution, effective at the US market opening on June 26, 2023. |

PNRG Price Returns

| 1-mo | 4.42% |

| 3-mo | 14.99% |

| 6-mo | 14.80% |

| 1-year | 22.46% |

| 3-year | N/A |

| 5-year | -6.06% |

| YTD | 10.26% |

| 2023 | 22.42% |

| 2022 | 23.92% |

| 2021 | 62.38% |

| 2020 | -71.46% |

| 2019 | 115.93% |

Continue Researching PNRG

Want to do more research on Primeenergy Resources Corp's stock and its price? Try the links below:Primeenergy Resources Corp (PNRG) Stock Price | Nasdaq

Primeenergy Resources Corp (PNRG) Stock Quote, History and News - Yahoo Finance

Primeenergy Resources Corp (PNRG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...