Pinnacle West Capital Corp. (PNW): Price and Financial Metrics

PNW Price/Volume Stats

| Current price | $84.71 | 52-week high | $85.00 |

| Prev. close | $83.59 | 52-week low | $65.20 |

| Day low | $83.70 | Volume | 492,900 |

| Day high | $85.00 | Avg. volume | 1,168,767 |

| 50-day MA | $77.91 | Dividend yield | 4.26% |

| 200-day MA | $73.83 | Market Cap | 9.62B |

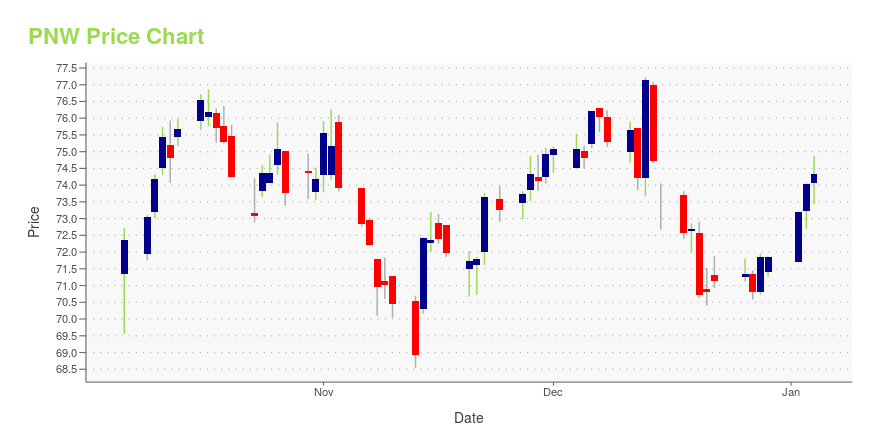

PNW Stock Price Chart Interactive Chart >

Pinnacle West Capital Corp. (PNW) Company Bio

Pinnacle West Capital Corporation is an American utility holding company that owns Arizona Public Service and Bright Canyon Energy. It is publicly traded on the New York Stock exchange and a component of the S&P 500 stock market index. (Source:Wikipedia)

Latest PNW News From Around the Web

Below are the latest news stories about PINNACLE WEST CAPITAL CORP that investors may wish to consider to help them evaluate PNW as an investment opportunity.

Insider Sell Alert: EVP, GC, and CDO Robert Smith Sells Shares of Pinnacle West Capital Corp (PNW)In a recent transaction on December 8, 2023, Robert Smith, the Executive Vice President, General Counsel, and Chief Development Officer of Pinnacle West Capital Corp (NYSE:PNW), sold 1,610 shares of the company. |

TotalEnergies (TTE) to Invest in 1 GW Kazakhstan Wind ProjectTotalEnergies (TTE) continues to expand its renewable energy portfolio globally and is on course to achieve 100 Terawatt hours of clean energy by 2030. |

ALE vs. PNW: Which Stock Is the Better Value Option?ALE vs. PNW: Which Stock Is the Better Value Option? |

Pinnacle West (PNW) Rides on Investments, Clean Power GenerationPinnacle West (PNW) is expected to further benefit from its long-term investment plan, clean power generation and expanding customer base. |

Global Water Resources (GWRS) Board Allows 1% Dividend HikeGlobal Water Resources (GWRS) continues to increase shareholders' value, as its board of directors approves a 1% quarterly dividend hike. |

PNW Price Returns

| 1-mo | 11.99% |

| 3-mo | 16.32% |

| 6-mo | 21.62% |

| 1-year | 5.63% |

| 3-year | 12.82% |

| 5-year | 14.13% |

| YTD | 20.83% |

| 2023 | -1.18% |

| 2022 | 13.01% |

| 2021 | -7.78% |

| 2020 | -7.68% |

| 2019 | 9.06% |

PNW Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PNW

Want to see what other sources are saying about Pinnacle West Capital Corp's financials and stock price? Try the links below:Pinnacle West Capital Corp (PNW) Stock Price | Nasdaq

Pinnacle West Capital Corp (PNW) Stock Quote, History and News - Yahoo Finance

Pinnacle West Capital Corp (PNW) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...