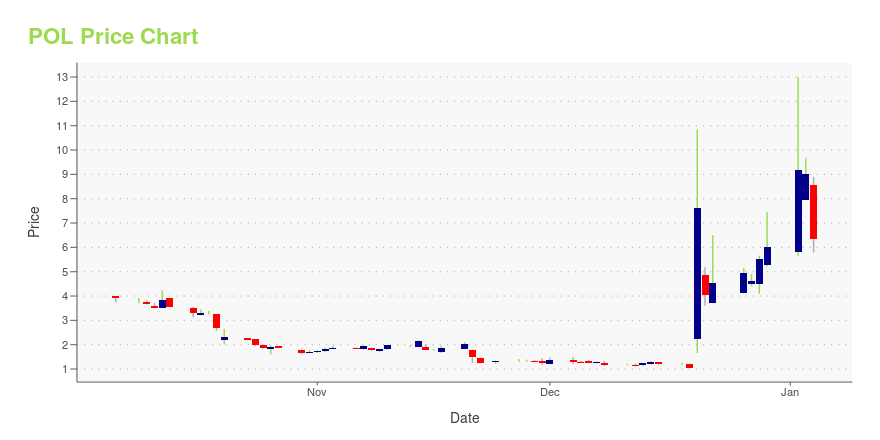

PolyOne Corporation (POL): Price and Financial Metrics

POL Price/Volume Stats

| Current price | $1.82 | 52-week high | $35.84 |

| Prev. close | $1.83 | 52-week low | $1.06 |

| Day low | $1.82 | Volume | 13,900 |

| Day high | $1.90 | Avg. volume | 797,341 |

| 50-day MA | $4.84 | Dividend yield | N/A |

| 200-day MA | $9.95 | Market Cap | 3.84M |

POL Stock Price Chart Interactive Chart >

PolyOne Corporation (POL) Company Bio

PolyOne Corporation provides specialized polymer materials, services, and solutions with operations in specialty polymer formulations, color and additive systems, plastic sheet and packaging solutions, and polymer distribution. The company was founded in 1927 and is based in Avon Lake, Ohio.

Latest POL News From Around the Web

Below are the latest news stories about POLISHEDCOM INC that investors may wish to consider to help them evaluate POL as an investment opportunity.

Polished.com Acknowledges Recent Trading ActivityBROOKLYN, N.Y., December 20, 2023--Polished.com Inc. (the "Company" or "Polished") (NYSE American: POL) today released the following statement regarding recent market activity in the Company's stock: |

Polished.com Inc. (AMEX:POL) Q3 2023 Earnings Call TranscriptPolished.com Inc. (AMEX:POL) Q3 2023 Earnings Call Transcript November 21, 2023 Operator: Good morning, and welcome to the Polished Third Quarter Earnings Conference Call. Please note that certain statements made during the call constitute forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Act of 1995 as amended. Such forward-looking […] |

Polished.com Announces Results for Third Quarter of 2023 and Amendment of Credit AgreementBROOKLYN, N.Y., November 20, 2023--Polished.com Inc. (NYSE American: POL) ("Polished" or the "Company") today reported financial results for the three months ended September 30, 2023. The Company’s 10-Q and additional information can be found on its investor relations website: https://investor.polished.com/financials/sec-filings. |

Polished.com Postpones Reporting of Third Quarter 2023 Financial ResultsBROOKLYN, N.Y., November 14, 2023--Polished.com Inc. (the "Company" or "Polished") (NYSE American: POL) today announced that the Company is postponing its earnings release and conference call for the third quarter ended September 30, 2023, which was previously scheduled for today, November 14, 2023. The Company requires additional time to finalize certain of the disclosures in its quarterly report. |

Polished.com Announces Date for Third Quarter 2023 Earnings ReleaseBROOKLYN, N.Y., November 06, 2023--Polished.com Inc. (the "Company" or "Polished") (NYSE American: POL) today announced that it will report third quarter 2023 earnings results after market close on Tuesday, November 14, 2023. |

POL Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | -58.73% |

| 1-year | -93.51% |

| 3-year | -98.73% |

| 5-year | N/A |

| YTD | -69.82% |

| 2023 | -79.12% |

| 2022 | -75.93% |

| 2021 | -71.50% |

| 2020 | N/A |

| 2019 | N/A |

Continue Researching POL

Want to do more research on Polyone Corp's stock and its price? Try the links below:Polyone Corp (POL) Stock Price | Nasdaq

Polyone Corp (POL) Stock Quote, History and News - Yahoo Finance

Polyone Corp (POL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...