ProAssurance Corporation (PRA): Price and Financial Metrics

PRA Price/Volume Stats

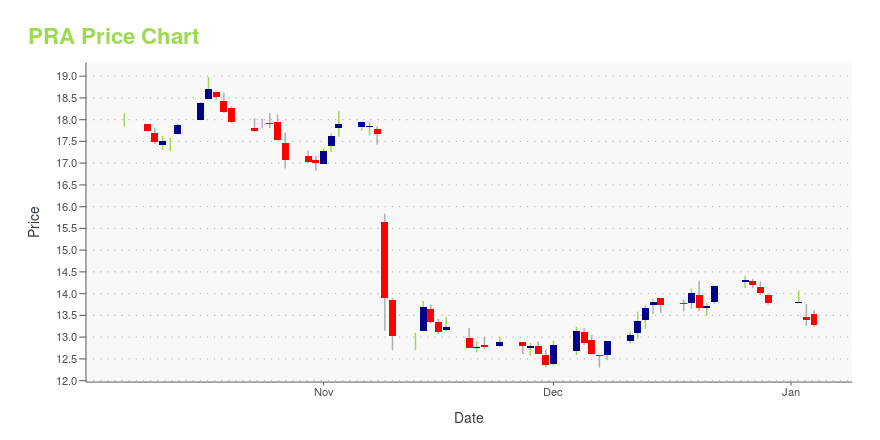

| Current price | $11.76 | 52-week high | $19.38 |

| Prev. close | $11.57 | 52-week low | $10.76 |

| Day low | $11.68 | Volume | 315,700 |

| Day high | $11.90 | Avg. volume | 283,627 |

| 50-day MA | $12.83 | Dividend yield | N/A |

| 200-day MA | $13.58 | Market Cap | 599.90M |

PRA Stock Price Chart Interactive Chart >

ProAssurance Corporation (PRA) Company Bio

ProAssurance Corporation provides property and casualty insurance, and reinsurance products in the United States. The company operates through four segments: Specialty Property and Casualty, Workers' Compensation, Lloyd's Syndicate, and Corporate. The company was founded in 1976 and is based in Birmingham, Alabama.

Latest PRA News From Around the Web

Below are the latest news stories about PROASSURANCE CORP that investors may wish to consider to help them evaluate PRA as an investment opportunity.

ProAssurance (PRA) Down 9.6% Since Last Earnings Report: Can It Rebound?ProAssurance (PRA) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

Here’s Why ProAssurance Corporation (PRA) Shares Increased by 25%TimesSquare Capital Management, an equity investment management company, released its “U.S. Small Cap Growth Strategy” third-quarter investor letter. A copy of the same can be downloaded here. In the quarter the fund returned -3.67% (net), compared to -7.32% return for the Russell 2000 Growth Index. Year-to-date the fund returned 11.56% (net) compared to 9.59% return for […] |

ProAssurance Corporation (NYSE:PRA) Q3 2023 Earnings Call TranscriptProAssurance Corporation (NYSE:PRA) Q3 2023 Earnings Call Transcript November 11, 2023 Frank O’Neil: Good morning, everyone. We reported on third quarter results in a news release issued November 8, 2023, and on our quarterly report on Form 10-Q, which was also filed on November 8, 2023. Included in those documents were cautionary statements about the […] |

Q3 2023 ProAssurance Corp Earnings CallQ3 2023 ProAssurance Corp Earnings Call |

ProAssurance (PRA) Incurs Q3 Loss Due to Weak Underwriting ResultsProAssurance's (PRA) third-quarter results suffer from lower net premiums earned from its segments and elevated loss trends. |

PRA Price Returns

| 1-mo | -5.24% |

| 3-mo | -10.71% |

| 6-mo | -13.53% |

| 1-year | -30.95% |

| 3-year | -42.14% |

| 5-year | -66.44% |

| YTD | -14.72% |

| 2023 | -20.84% |

| 2022 | -30.28% |

| 2021 | 43.40% |

| 2020 | -49.70% |

| 2019 | -7.90% |

Continue Researching PRA

Here are a few links from around the web to help you further your research on Proassurance Corp's stock as an investment opportunity:Proassurance Corp (PRA) Stock Price | Nasdaq

Proassurance Corp (PRA) Stock Quote, History and News - Yahoo Finance

Proassurance Corp (PRA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...