Primerica, Inc. (PRI): Price and Financial Metrics

PRI Price/Volume Stats

| Current price | $250.52 | 52-week high | $256.56 |

| Prev. close | $250.26 | 52-week low | $184.76 |

| Day low | $249.68 | Volume | 188,292 |

| Day high | $252.52 | Avg. volume | 168,517 |

| 50-day MA | $234.02 | Dividend yield | 1.19% |

| 200-day MA | $225.26 | Market Cap | 8.62B |

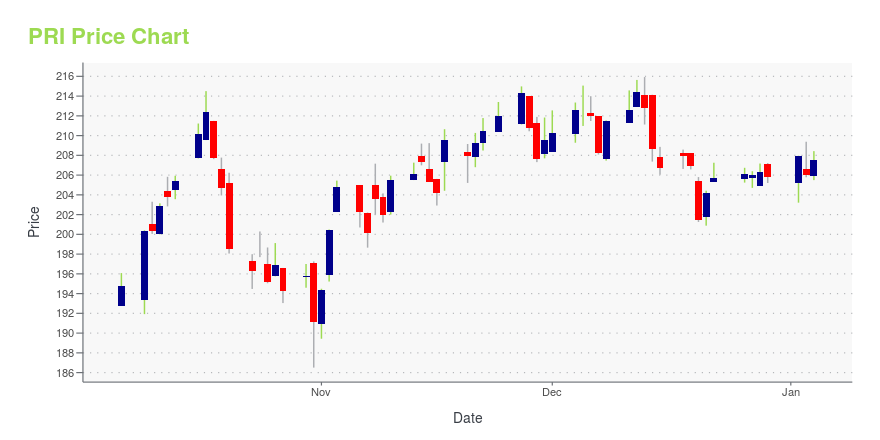

PRI Stock Price Chart Interactive Chart >

Primerica, Inc. (PRI) Company Bio

Primerica distributes financial products to middle income households in the United States and Canada. The company operates in three segments: Term Life Insurance; Investment and Savings Products; and Corporate and Other Distributed Products. The company was founded in 1977 and is based in Duluth, Georgia.

Latest PRI News From Around the Web

Below are the latest news stories about PRIMERICA INC that investors may wish to consider to help them evaluate PRI as an investment opportunity.

Here's Why Primerica (PRI) Stock is Investors' Favorite NowA compelling portfolio, strong market presence position and solid capital position poise Primerica (PRI) for growth. |

Manulife's (MFC) Stock Surges 22% YTD: More Upside Left?Manulife (MFC) appears well poised for growth on its strengthening Asia business, expanding Wealth and Asset Management business, cost savings to improve profitability and solid capital position. |

Primerica Names Tracy Tan as Chief Financial OfficerDULUTH, Ga., December 18, 2023--Primerica, Inc. (NYSE:PRI), a leading provider of financial products and services to middle-income families in the United States and Canada, today announced the promotion of Tracy Tan, Executive Vice President of Finance, to the position of Chief Financial Officer, effective December 20, 2023. It was previously announced that Ms. Tan would be the successor to the Company’s Chief Financial Officer, Alison Rand, no later than April 1, 2024. As the Chief Financial Of |

Lincoln National (LNC) Inks Deal to Sell Wealth Management UnitLincoln National (LNC) inks a deal with Osaic to divest LFA and LFS and plans to increase its RBC ratio with the transaction proceeds. It also aims to focus more on growing its core businesses. |

Reinsurance Group (RGA) Rises 17% YTD: Will the Rally Last?Higher new business volumes, better pricing, stronger invested asset base, business expansion , solid in-force business and effective capital deployment poise Reinsurance Group (RGA) for growth. |

PRI Price Returns

| 1-mo | 6.22% |

| 3-mo | 17.75% |

| 6-mo | 11.53% |

| 1-year | 20.30% |

| 3-year | 79.13% |

| 5-year | 114.09% |

| YTD | 22.53% |

| 2023 | 47.07% |

| 2022 | -5.94% |

| 2021 | 15.86% |

| 2020 | 3.91% |

| 2019 | 35.11% |

PRI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PRI

Want to see what other sources are saying about Primerica Inc's financials and stock price? Try the links below:Primerica Inc (PRI) Stock Price | Nasdaq

Primerica Inc (PRI) Stock Quote, History and News - Yahoo Finance

Primerica Inc (PRI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...