Primoris Services Corporation (PRIM): Price and Financial Metrics

PRIM Price/Volume Stats

| Current price | $56.15 | 52-week high | $56.83 |

| Prev. close | $54.41 | 52-week low | $28.96 |

| Day low | $55.45 | Volume | 503,865 |

| Day high | $56.46 | Avg. volume | 556,593 |

| 50-day MA | $52.54 | Dividend yield | 0.43% |

| 200-day MA | $40.66 | Market Cap | 3.01B |

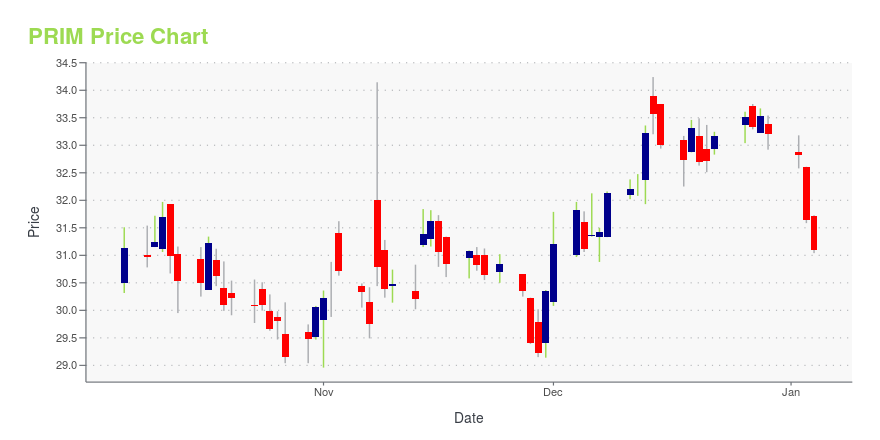

PRIM Stock Price Chart Interactive Chart >

Primoris Services Corporation (PRIM) Company Bio

Primoris Services Corporation provides a wide range of construction, fabrication, maintenance, replacement, water and wastewater, and engineering services to major public utilities, petrochemical companies, energy companies, municipalities, and other customers. The company was founded in 1960 and is based in Dallas, Texas.

Latest PRIM News From Around the Web

Below are the latest news stories about PRIMORIS SERVICES CORP that investors may wish to consider to help them evaluate PRIM as an investment opportunity.

Primoris CEO sells stock worth $1.7MMore on Primoris Services |

Primoris Services Corporation Receives Projects Valued Over $800 MillionDALLAS, December 07, 2023--Primoris Services Corporation (NYSE: PRIM) ("Primoris" or the "Company") announced today it received several awards with a combined value over $800 million secured by the Company’s Energy Segment, including more than $300 million for engineering, procurement and construction of utility-scale solar projects. |

Sidoti Events, LLC’s Virtual November Micro-Cap ConferenceNEW YORK, NY / ACCESSWIRE / November 14, 2023 / Sidoti Events, LLC, an affiliate of Sidoti & Company, LLC, has released the presentation schedule and weblinks for its two-day November Micro-Cap Conference taking place Wednesday and Thursday, November ... |

Primoris Services Corporation to Participate in Investor ConferencesDALLAS, November 13, 2023--Primoris Services Corporation (NYSE: PRIM) ("Primoris" or the "Company") announced today that the Company’s management team will participate in two institutional investor conferences in November. |

Primoris Services Corporation Reports Third Quarter 2023 ResultsDALLAS, November 07, 2023--Primoris Services Corporation (NYSE: PRIM) ("Primoris" or the "Company") today announced financial results for its third quarter ended September 30, 2023 and provided comments on the Company’s operational performance and outlook for 2023. |

PRIM Price Returns

| 1-mo | 10.21% |

| 3-mo | 21.10% |

| 6-mo | 73.06% |

| 1-year | 79.49% |

| 3-year | 102.76% |

| 5-year | 189.36% |

| YTD | 69.52% |

| 2023 | 52.60% |

| 2022 | -7.46% |

| 2021 | -12.38% |

| 2020 | 25.81% |

| 2019 | 17.62% |

PRIM Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PRIM

Here are a few links from around the web to help you further your research on Primoris Services Corp's stock as an investment opportunity:Primoris Services Corp (PRIM) Stock Price | Nasdaq

Primoris Services Corp (PRIM) Stock Quote, History and News - Yahoo Finance

Primoris Services Corp (PRIM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...