Profound Medical Corp. (PROF): Price and Financial Metrics

PROF Price/Volume Stats

| Current price | $11.18 | 52-week high | $12.81 |

| Prev. close | $10.89 | 52-week low | $7.11 |

| Day low | $10.89 | Volume | 37,000 |

| Day high | $11.42 | Avg. volume | 36,439 |

| 50-day MA | $8.76 | Dividend yield | N/A |

| 200-day MA | $8.70 | Market Cap | 273.70M |

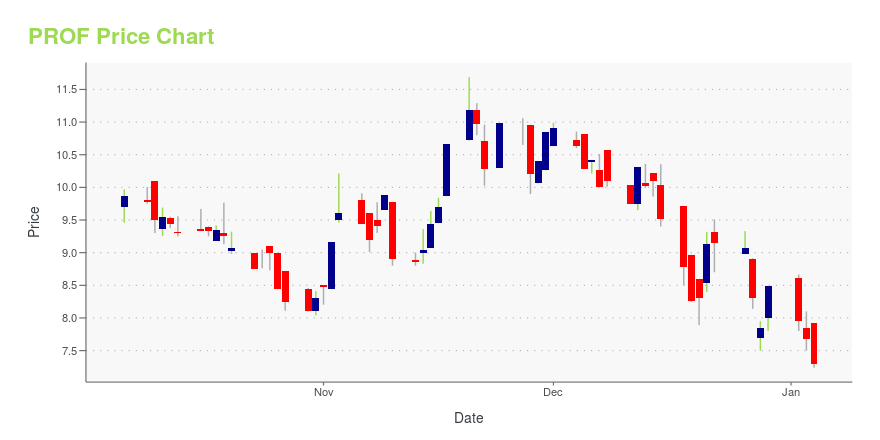

PROF Stock Price Chart Interactive Chart >

Profound Medical Corp. (PROF) Company Bio

Profound Medical Corp. operates as a medical device company. The Company develops and commercializes technology for the treatment of localized prostate cancer. Profound Medical offers its services worldwide.

Latest PROF News From Around the Web

Below are the latest news stories about PROFOUND MEDICAL CORP that investors may wish to consider to help them evaluate PROF as an investment opportunity.

Profound Medical Announces Pricing of US$20 Million Public Offering of Common SharesTORONTO, Dec. 27, 2023 (GLOBE NEWSWIRE) -- Profound Medical Corp. (TSX:PRN; NASDAQ:PROF) (“Profound” or the “Company”) today announced the pricing of its previously announced underwritten public offering (the “Offering”) of 2,666,667 common shares (the “Common Shares”) at a price to the public of US$7.50 per Common Share, led by healthcare focused institutional investors. Gross proceeds to the Company from the Offering are expected to be approximately US$20,000,000, prior to deducting underwriti |

Profound Medical Announces Proposed Public Offering of Common SharesTORONTO, Dec. 27, 2023 (GLOBE NEWSWIRE) -- Profound Medical Corp. (TSX:PRN; NASDAQ:PROF) (“Profound” or the “Company”) is pleased to announce the commencement of an underwritten public offering in the United States of common shares (the “Common Shares”) in the capital of the Company (the “Offering”). The Company intends to file a preliminary prospectus supplement (the “Preliminary Supplement”) to its short form base shelf prospectus dated March 23, 2022 (the “Base Shelf Prospectus”) in the Unite |

Profound Medical to Participate in the Stifel 2023 Healthcare ConferenceTORONTO, Nov. 08, 2023 (GLOBE NEWSWIRE) -- Profound Medical Corp. (NASDAQ:PROF; TSX:PRN) (“Profound” or the “Company”), a commercial-stage medical device company that develops and markets customizable, incision-free therapies for the ablation of diseased tissue, today announced that management will present an update on the Company’s business at the Stifel 2023 Healthcare Conference on Wednesday, November 15, 2023 at 8:35 a.m. Eastern Time in NYC. The presentation will be broadcast live and archi |

Profound Medical Announces CMS Extension of Temporary ‘Code’ for TULSA to ASC SettingTORONTO, Nov. 03, 2023 (GLOBE NEWSWIRE) -- Profound Medical Corp. (NASDAQ:PROF; TSX:PRN) (“Profound” or the “Company”), a commercial-stage medical device company that develops and markets customizable, incision-free therapies for the ablation of diseased tissue, announced today that, pursuant to the 2024 Final Rule published yesterday by the U.S. Centers for Medicare and Medicaid Services (“CMS”), use of HCPCS C code, C9734, previously established for the Hospital Outpatient Prospective Payment |

Profound Medical Announces Third Quarter 2023 Financial ResultsTORONTO, Nov. 02, 2023 (GLOBE NEWSWIRE) -- Profound Medical Corp. (NASDAQ:PROF; TSX:PRN) (“Profound” or the “Company”), a commercial-stage medical device company that develops and markets customizable, incision-free therapies for the ablation of diseased tissue, today reported financial results for the third quarter ended September 30, 2023. Unless specified otherwise, all amounts in this press release are expressed in U.S. dollars and are presented in accordance with International Financial Rep |

PROF Price Returns

| 1-mo | 26.13% |

| 3-mo | 39.23% |

| 6-mo | 23.40% |

| 1-year | -9.69% |

| 3-year | -23.89% |

| 5-year | 89.68% |

| YTD | 31.68% |

| 2023 | -22.04% |

| 2022 | -3.03% |

| 2021 | -45.38% |

| 2020 | 87.76% |

| 2019 | 160.71% |

Loading social stream, please wait...