Purple Innovation Inc. (PRPL): Price and Financial Metrics

PRPL Price/Volume Stats

| Current price | $1.43 | 52-week high | $3.33 |

| Prev. close | $1.34 | 52-week low | $0.55 |

| Day low | $1.33 | Volume | 372,500 |

| Day high | $1.47 | Avg. volume | 663,212 |

| 50-day MA | $1.19 | Dividend yield | N/A |

| 200-day MA | $1.24 | Market Cap | 153.99M |

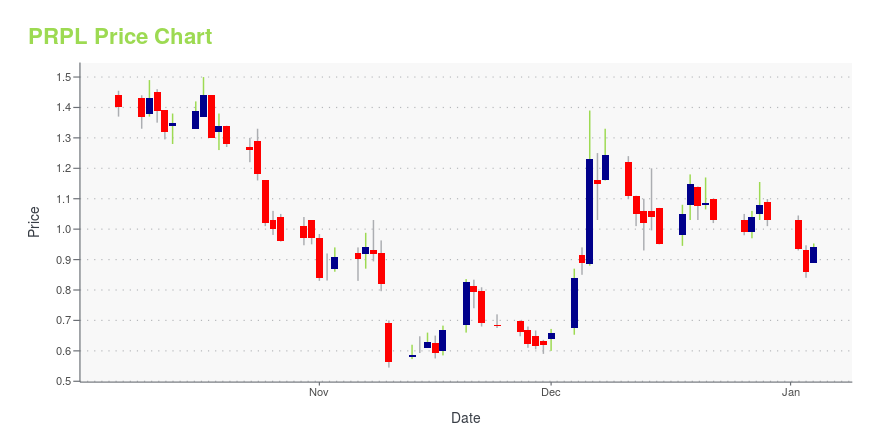

PRPL Stock Price Chart Interactive Chart >

Purple Innovation Inc. (PRPL) Company Bio

Purple Innovation, Inc. engages in the design and manufacture of comfort technology products. It offers mattresses, bed pillows, seat cushions, mattress protector, and bamboo sheets. The company was founded by Terry V. Pearce and Tony M. Pearce in 1989 and is headquartered in Lehi, Utah.

Latest PRPL News From Around the Web

Below are the latest news stories about PURPLE INNOVATION INC that investors may wish to consider to help them evaluate PRPL as an investment opportunity.

Purple Announces Positive Black Friday/Cyber Monday Weekend Selling Period and Reiterates 2023 Full Year Outlook Ahead of Investor ConferencesPurple Innovation, Inc. (NASDAQ: PRPL) ("Purple"), a comfort innovation company known for creating the "World's First No Pressure® Mattress," today announced positive year-over-year sales results for the Black Friday through Cyber Monday period (November 24-27, 2023) and reiterated its 2023 full year outlook. |

Purple Introduces Two New Pillows That Offer Deeper Sleep Through Customization and PortabilityPurple Innovation, Inc. (NASDAQ: PRPL) ("Purple"), the world leader and inventor of the GelFlex® Grid and holder of over 150 patents, today announced an extension to its pillow line with two new offerings: Purple Harmony™ Anywhere, a travel sized version of the best-selling Harmony pillow; and Freeform™, a customizable pillow. These new pillows join the selection of Purple's wildly popular pillow line featuring the brand's signature GelFlex® Grid, which is engineered to alleviate aches and balan |

Purple Innovation, Inc. (NASDAQ:PRPL) Q3 2023 Earnings Call TranscriptPurple Innovation, Inc. (NASDAQ:PRPL) Q3 2023 Earnings Call Transcript November 9, 2023 Operator: Good afternoon, ladies and gentlemen. Welcome to Purple Innovation Third Quarter 2023 Earnings Conference Call. [Operator Instructions] It is now my pleasure to introduce your host, Cody McAlester of ICR. Please go ahead. Cody McAlester: Thank you for joining Purple Innovation’s third […] |

Q3 2023 Purple Innovation Inc Earnings CallQ3 2023 Purple Innovation Inc Earnings Call |

Purple Innovation Reports Third Quarter 2023 ResultsPurple Innovation, Inc. (NASDAQ: PRPL) ("Purple"), a comfort innovation company known for creating the "World's First No Pressure ™ Mattress," today announced results for the third quarter ended September 30, 2023. |

PRPL Price Returns

| 1-mo | 45.65% |

| 3-mo | -5.61% |

| 6-mo | 36.19% |

| 1-year | -53.57% |

| 3-year | -94.49% |

| 5-year | -77.90% |

| YTD | 38.83% |

| 2023 | -78.50% |

| 2022 | -63.90% |

| 2021 | -59.71% |

| 2020 | 278.19% |

| 2019 | 47.88% |

Continue Researching PRPL

Want to do more research on Purple Innovation Inc's stock and its price? Try the links below:Purple Innovation Inc (PRPL) Stock Price | Nasdaq

Purple Innovation Inc (PRPL) Stock Quote, History and News - Yahoo Finance

Purple Innovation Inc (PRPL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...