CarParts.com Inc. (PRTS): Price and Financial Metrics

PRTS Price/Volume Stats

| Current price | $1.25 | 52-week high | $5.10 |

| Prev. close | $1.20 | 52-week low | $0.96 |

| Day low | $1.16 | Volume | 1,982,941 |

| Day high | $1.45 | Avg. volume | 835,720 |

| 50-day MA | $1.11 | Dividend yield | N/A |

| 200-day MA | $2.20 | Market Cap | 70.87M |

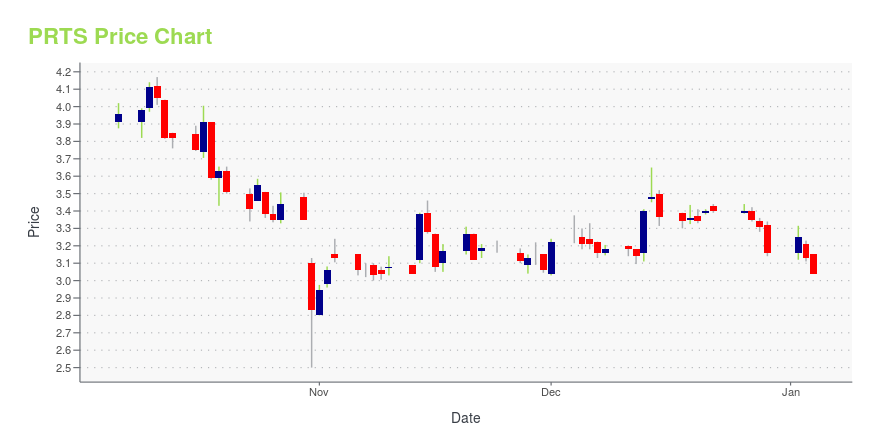

PRTS Stock Price Chart Interactive Chart >

CarParts.com Inc. (PRTS) Company Bio

CarParts.com, Inc. operates as an online provider of aftermarket auto parts and accessories in the United States and the Philippines. Its products include Collision Parts, Engine Parts, Performance Parts and Accessories. The firm also sells auto parts to collision repair shops, markets Kool-Vue products to auto parts wholesale distributor, and aftermarket catalytic converters under the Evan Fischer brand. Its flagship Websites include www.carparts.com, www.jcwhitney.com, www.autopartswarehouse.com and www.usautoparts.com. The company was founded by Sol Khazani and Mehran Nia in 1995 and is headquartered in Carson, CA.

Latest PRTS News From Around the Web

Below are the latest news stories about CARPARTSCOM INC that investors may wish to consider to help them evaluate PRTS as an investment opportunity.

Small Stocks, Big Potential: 7 Penny Stocks Poised for Major Gains in 2024Wager on these three top penny stocks shining through market uncertainty at this time, poised for a year-end rally |

Searching for Growth? 3 Small-Cap Stocks With Triple-Digit UpsideDigging a little deeper can uncover big winners. |

CarParts.com Introduces Innovative Content Hub to Enhance Customer Journey with Podcasts, Revamped Blog, and Extensive Video LibraryCarParts.com, a leading online retailer of automotive parts and accessories, has announced the launch of a refreshed content marketing strategy, aimed at enhancing the customer experience. The new hub helps consumers learn about their vehicle's maintenance and repair needs; features include links to purchase products directly from the CarParts.com website or mobile app, and how-to videos that allow individuals to tackle easy jobs at home. |

7 Small-Cap Stocks Set to Soar as Interest Rates StabilizeSmall-cap stocks traditionally fare very well at this point in the business cycle adn these 7 look particularly strong. |

7 Stocks to Buy if You Anticipate a Hot NovemberWhile enough evidence exists that justify a pessimistic view of the market – in particular, high inflation and high borrowing costs – it’s also possible that a hot November could rejuvenate previously embattled stocks to buy. |

PRTS Price Returns

| 1-mo | 15.74% |

| 3-mo | 3.31% |

| 6-mo | -56.90% |

| 1-year | -74.17% |

| 3-year | -92.82% |

| 5-year | 2.46% |

| YTD | -60.44% |

| 2023 | -49.52% |

| 2022 | -44.11% |

| 2021 | -9.60% |

| 2020 | 463.18% |

| 2019 | 141.76% |

Continue Researching PRTS

Want to see what other sources are saying about US Auto Parts Network Inc's financials and stock price? Try the links below:US Auto Parts Network Inc (PRTS) Stock Price | Nasdaq

US Auto Parts Network Inc (PRTS) Stock Quote, History and News - Yahoo Finance

US Auto Parts Network Inc (PRTS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...