Privia Health Group, Inc. (PRVA): Price and Financial Metrics

PRVA Price/Volume Stats

| Current price | $20.46 | 52-week high | $28.10 |

| Prev. close | $19.99 | 52-week low | $15.92 |

| Day low | $19.99 | Volume | 423,617 |

| Day high | $20.50 | Avg. volume | 919,609 |

| 50-day MA | $17.55 | Dividend yield | N/A |

| 200-day MA | $20.14 | Market Cap | 2.44B |

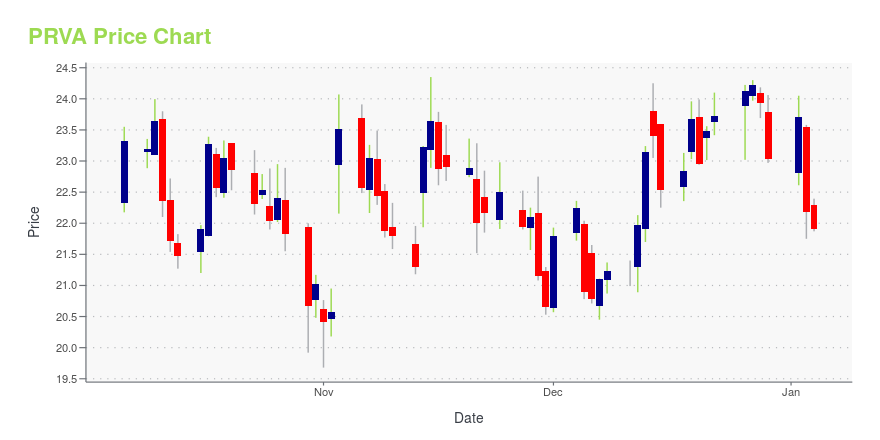

PRVA Stock Price Chart Interactive Chart >

Privia Health Group, Inc. (PRVA) Company Bio

Privia Health Group, Inc. operates as a physician practice management and population health technology company in the United States. The company comprises regional medical groups, accountable care organizations, and specialty verticals. It offers technology and population health tools to enhance independent providers' workflows; management service organization that enables providers to reduce administrative work focus on their patients; single-TIN medical group that facilitates payer negotiation, clinical integration and alignment of financial incentives; physician-led accountable care organization, which engages patients, reduces inappropriate utilization, and enhances coordination and patient quality metrics to drive value-based care and transform the healthcare delivery system; and network for purchasers and payers. The company was founded in 2007 and is headquartered in Arlington, Virginia. Privia Health Group, Inc. operates as a subsidiary of Brighton Health Group Holdings, LLC.

Latest PRVA News From Around the Web

Below are the latest news stories about PRIVIA HEALTH GROUP INC that investors may wish to consider to help them evaluate PRVA as an investment opportunity.

Privia Health Group, Inc. (NASDAQ:PRVA) Q3 2023 Earnings Call TranscriptPrivia Health Group, Inc. (NASDAQ:PRVA) Q3 2023 Earnings Call Transcript November 5, 2023 Operator: Good day, and thank you for standing by. Welcome to the Privia Health Third Quarter Conference Call. [Operator Instructions] Please be advised that today’s conference is being recorded. I would now like to hand the conference over to your speaker today, […] |

Privia Health Group, Inc.'s (NASDAQ:PRVA) P/S Still Appears To Be ReasonableWhen you see that almost half of the companies in the Healthcare industry in the United States have price-to-sales... |

Q3 2023 Privia Health Group Inc Earnings CallQ3 2023 Privia Health Group Inc Earnings Call |

OMCL vs. PRVA: Which Stock Should Value Investors Buy Now?OMCL vs. PRVA: Which Stock Is the Better Value Option? |

Compared to Estimates, Privia Health (PRVA) Q3 Earnings: A Look at Key MetricsThe headline numbers for Privia Health (PRVA) give insight into how the company performed in the quarter ended September 2023, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals. |

PRVA Price Returns

| 1-mo | 24.15% |

| 3-mo | 12.05% |

| 6-mo | -10.42% |

| 1-year | -21.88% |

| 3-year | -53.26% |

| 5-year | N/A |

| YTD | -11.16% |

| 2023 | 1.41% |

| 2022 | -12.21% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...