Paysafe Limited (PSFE): Price and Financial Metrics

PSFE Price/Volume Stats

| Current price | $12.98 | 52-week high | $26.25 |

| Prev. close | $13.30 | 52-week low | $11.60 |

| Day low | $12.97 | Volume | 435,604 |

| Day high | $13.46 | Avg. volume | 395,536 |

| 50-day MA | $13.10 | Dividend yield | N/A |

| 200-day MA | $17.28 | Market Cap | 777.35M |

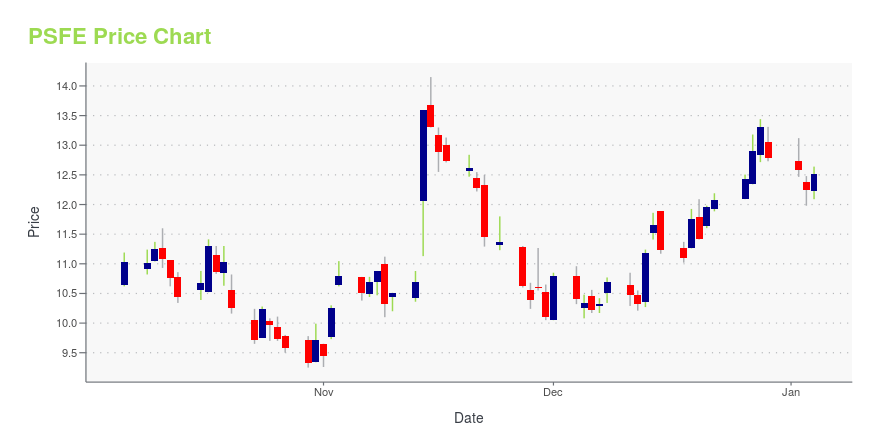

PSFE Stock Price Chart Interactive Chart >

Paysafe Limited (PSFE) Company Bio

Paysafe Group HPaysafe Groupoldings Limited offers payment processing, payment gateway, payment wallet, and related merchant services. Paysafe Group Holdings Limited was formerly known as PI UK Holdco I Ltd and changed its name to Paysafe Group Holdings Limited in May 2018. The company was incorporated 2017 and is based in London, United Kingdom. Paysafe Group Holdings Limited operates as a subsidiary of Pi Jersey Topco Limited (Topco).

PSFE Price Returns

| 1-mo | 7.36% |

| 3-mo | -10.05% |

| 6-mo | -27.81% |

| 1-year | -34.58% |

| 3-year | -40.24% |

| 5-year | N/A |

| YTD | -24.09% |

| 2024 | 33.70% |

| 2023 | -7.92% |

| 2022 | -70.40% |

| 2021 | -74.11% |

| 2020 | N/A |

Loading social stream, please wait...